We enter into a shortened week, with an early expiry for Nifty due to the Diwali Holidays. Nifty broke below its important support of 5050 on Friday, but could not break the next support of 5030. This level will be a reference level on the downside for tomorrow. If Nifty breaks this level, then a Short trade will be on, with stoploss above Friday's closing price. On the upside, the level of 5075/5080 will be the reference point. Above this level, nifty may again go to retest 5120. Stoploss for this long trade will also be Friday's closing price. In between these two levels, rangebound trading is bound to continue.

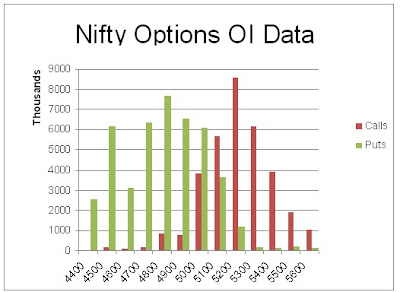

We enter into a shortened week, with an early expiry for Nifty due to the Diwali Holidays. Nifty broke below its important support of 5050 on Friday, but could not break the next support of 5030. This level will be a reference level on the downside for tomorrow. If Nifty breaks this level, then a Short trade will be on, with stoploss above Friday's closing price. On the upside, the level of 5075/5080 will be the reference point. Above this level, nifty may again go to retest 5120. Stoploss for this long trade will also be Friday's closing price. In between these two levels, rangebound trading is bound to continue.The Nifty option Open Interest charts are given below:

Small addition was done by the Bulls at 5000 CE and 5100 CE strikes, while the Bulls covered big quantity of 12 lacs+ OI at 5100 PE and 5200 PE strikes. After Friday's action, 4900 to 5200 remains the range as per the Options Charts. 5000 is a minor support, while 5100 is a minor resistance. The earlier identified levels of 5030/4970 and 5075/5120 are the levels to watchout for action in the Options Open Interest Levels.

Small addition was done by the Bulls at 5000 CE and 5100 CE strikes, while the Bulls covered big quantity of 12 lacs+ OI at 5100 PE and 5200 PE strikes. After Friday's action, 4900 to 5200 remains the range as per the Options Charts. 5000 is a minor support, while 5100 is a minor resistance. The earlier identified levels of 5030/4970 and 5075/5120 are the levels to watchout for action in the Options Open Interest Levels.For tomorrow, immediate resistance for Nifty Spot comes at 5075/5080 levels. Above this, the Bulls will again take it to test resistance zone of 5120/5130. If manages to sustain above 5130, it will head towards 5170+ levels this expiry. On the downside, Support for Nifty Spot comes at 5030 levels. Below this, a slide towards 5005/4970 will come. Below 4970, the Bulls are expected to give in to Bear Pressure for this Expiry.

24 Oct - Nifty Spot resistance at 5070-5090-5120-5150. Support at 5030-5005-4970-4945 - www.niftypower.com

Visit here for Nifty Future and Nifty Option Tips

No comments:

Post a Comment