Last week, we had indicated in the Post of 13th Oct, it was indicated that traders will have to wait to see if Nifty reaches and close above the strong resistance band of 5180/5230. The outcome of that wait should be seen this week. Nifty has made some good breakouts and is strikingly close to the that gap area. At this juncture, traders can think of buying an option Straddle (of 5100 PE and CE or 5200 and CE combination). This is based on the assumption that whatever Nifty does near these levels, it will be very difficult for it to sustain in this resistance band. Hence, we can expect increased volatility, as Nifty approaches this band.

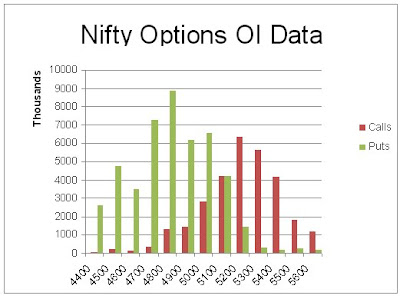

Last week, we had indicated in the Post of 13th Oct, it was indicated that traders will have to wait to see if Nifty reaches and close above the strong resistance band of 5180/5230. The outcome of that wait should be seen this week. Nifty has made some good breakouts and is strikingly close to the that gap area. At this juncture, traders can think of buying an option Straddle (of 5100 PE and CE or 5200 and CE combination). This is based on the assumption that whatever Nifty does near these levels, it will be very difficult for it to sustain in this resistance band. Hence, we can expect increased volatility, as Nifty approaches this band. The Nifty option Open Interest charts are given below:

As expected on an up day, the Bulls added nearly 25 lacs OI at 5000 PE and 5100 PE strike, while the Bears mostly covered at 5100 CE and below strikes. 5100 is the battlezone levels as of now, with almost equal OI of 42 lacs at 5100 PE and 5100 CE strikes. 5200 stands tall as the toughest resistance, while support exists from 5000 and below levels. As long as Nifty stays above 5000/5030 levels, the present trend can be assumed to be up, and buy on dips should be the strategy for traders.

As expected on an up day, the Bulls added nearly 25 lacs OI at 5000 PE and 5100 PE strike, while the Bears mostly covered at 5100 CE and below strikes. 5100 is the battlezone levels as of now, with almost equal OI of 42 lacs at 5100 PE and 5100 CE strikes. 5200 stands tall as the toughest resistance, while support exists from 5000 and below levels. As long as Nifty stays above 5000/5030 levels, the present trend can be assumed to be up, and buy on dips should be the strategy for traders.For tomorrow, immediate resistance for Nifty Spot comes at 5145/5150 levels, above which it will heads for the much talked about resistance band of 5170/5205 and 5230. if Bulls manage to stay and close Nifty above 5230, the the Gap Area from 5230 to 5325 will be attempted by them. On the downside, support for nifty Spot comes at 5110/5115. Below this, next supports comes at 5085, 5065 and 5030 levels. If breaks and trades below 5030, then this uptrend will come into question.

17 Oct - Nifty Spot resistance at 5145-5175-5205-5230. Support at 5110-5085-5065-5030 - www.niftypower.com

Visit here for Nifty Option Tips and Nifty Future Tips

No comments:

Post a Comment