Nifty opened Gap Down today, on negative global cues, broke our level of 5030 in intraday, but then recovered and closed above it. In the process, it formed a Bullish Dragonfly Doji on daily charts. It is not textbook pattern, but we may still consider it a bullish sign if we get a confirmation move tomorrow or this week. That confirmation will first comes on Nifty trading above 5085 and then 5120 . On the downside, it still has to respect 5030/5020 levels. Break and close below these levels would turn the immediate short term trend down.

Nifty opened Gap Down today, on negative global cues, broke our level of 5030 in intraday, but then recovered and closed above it. In the process, it formed a Bullish Dragonfly Doji on daily charts. It is not textbook pattern, but we may still consider it a bullish sign if we get a confirmation move tomorrow or this week. That confirmation will first comes on Nifty trading above 5085 and then 5120 . On the downside, it still has to respect 5030/5020 levels. Break and close below these levels would turn the immediate short term trend down.The Nifty option Open Interest charts are given below:

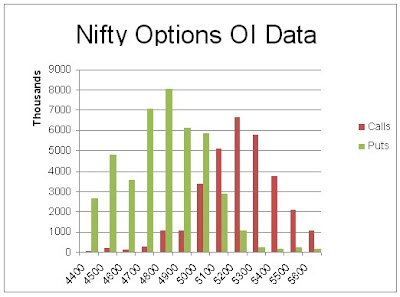

The Bulls covered nearly 16 lacs OI at 5000 PE and 5100 PE strikes, while the Bears added 6 lacs at 5000 CE. Most notable was the huge amount of covering at 5100 PE. After today's move, 5100 has again become a minor resistance point, while 5000 remains a minor support. 5200 remains the biggest hurdles for the Bulls on the upside. 5000 and below are the supports.

The Bulls covered nearly 16 lacs OI at 5000 PE and 5100 PE strikes, while the Bears added 6 lacs at 5000 CE. Most notable was the huge amount of covering at 5100 PE. After today's move, 5100 has again become a minor resistance point, while 5000 remains a minor support. 5200 remains the biggest hurdles for the Bulls on the upside. 5000 and below are the supports.For tomorrow, immediate resistance for nifty Spot comes at 5060/5085 levels. Above 5085, the Bulls will again try to conquer 5120-5150 and 5175 levels. On the downside, support for Nifty Spot comes at 5030/5020 levels. Below 5020, intraday slide towards 5005/4970 levels can be seen. Below 4970, Bears will take over the trend.

19 Oct - Nifty Spot resistance at 5060-5085-5120-5150. Support at 5025-5005-4970-4950 - www.niftypower.com

Visit here for Nifty Option Tips and Nifty Future Tips

No comments:

Post a Comment