On Monday, Nifty opened down on negative global cues, and then remained rangebound for almost the entire day. After the big upmove of past week, the movement of last two trading days can be termed as consolidating moves. Soon, volatility should pick up. As given yesterday also, on any down day, the support formed should hold, for this upmove to remain valid. The immediate support formed over the past few days is in the 5320/5330 zone. Once Nifty moves below it, this zone will act as a resistance. Those who are out from the market, can then enter on a fresh breakout from this zone. On the downside, important supports exist at 5280/5230 and 5210 levels. These supports should hold on any downmove due to negative global markets. Break and close below these will be the first sign of weakness now. Till then, Buy on Dips should be the mantra for traders.

On Monday, Nifty opened down on negative global cues, and then remained rangebound for almost the entire day. After the big upmove of past week, the movement of last two trading days can be termed as consolidating moves. Soon, volatility should pick up. As given yesterday also, on any down day, the support formed should hold, for this upmove to remain valid. The immediate support formed over the past few days is in the 5320/5330 zone. Once Nifty moves below it, this zone will act as a resistance. Those who are out from the market, can then enter on a fresh breakout from this zone. On the downside, important supports exist at 5280/5230 and 5210 levels. These supports should hold on any downmove due to negative global markets. Break and close below these will be the first sign of weakness now. Till then, Buy on Dips should be the mantra for traders.The Nifty option Open Interest charts are given below:

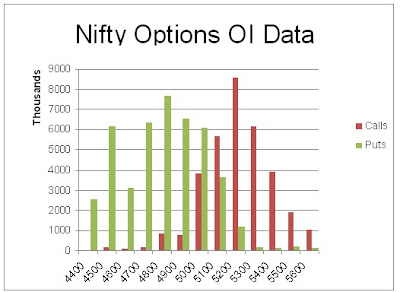

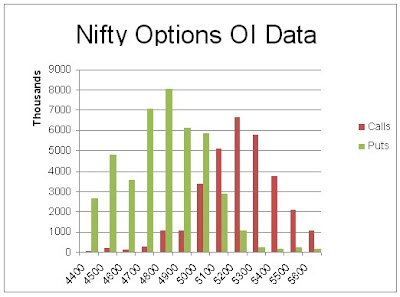

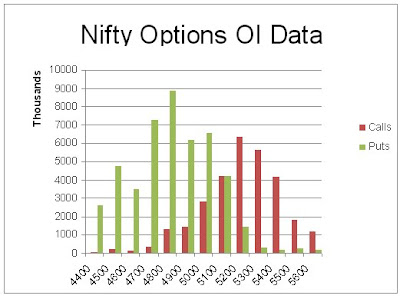

It was a muted day from the Option writers today. The Bulls added 11 lacs+ OI at 5200 PE and 5300 PE strikes. The Bears added 14 lacs+ OI at 5300 CE to 5500 CE strike. The range as per the Option Charts remain to be 5000 to 5400, with 5300 as the battlezone levels between the Bulls and the bears. 5200 and 5100 are the minor support levels as of now.

It was a muted day from the Option writers today. The Bulls added 11 lacs+ OI at 5200 PE and 5300 PE strikes. The Bears added 14 lacs+ OI at 5300 CE to 5500 CE strike. The range as per the Option Charts remain to be 5000 to 5400, with 5300 as the battlezone levels between the Bulls and the bears. 5200 and 5100 are the minor support levels as of now.For tomorrow, immediate resistance for Nifty Spot comes at 5330/5340 levels, above which, the Bulls are expected to take Nifty to higher levels of 5365 and 5405 levels. On the downside, support for Nifty Spot comes at 5320/5315 levels. Below this, next support for Nifty spot comes around 5280 levels. Below 5320, Nifty Spot can attempt to fill the gap till 5230 levels. However, it will still be advisable to build long positions at lower levels, with closing stoploss below 5200.

1 Nov - Nifty Spot resistance at 5340-5365-5405-5455. Support at 5320-5285-5250-5230 - www.niftypower.com

Visit here for Nifty Options Tips and Nifty Future Tips