Nifty ended the second consecutive correction week last week, closing near 5360 level. The positive point for the Bulls is that it was able to hold on to the its support of 5320/5300 Spot on closing basis. Upside major resistance for next week comes at 5430/5460 levels, and positional shorts can lower their stoploss to this level. Once it closes and sustains above 5400 Spot, this correction can deemed to be over and Positional Longs can be opened. Till then, prefer to Sell with stoploss above 5400 Spot.

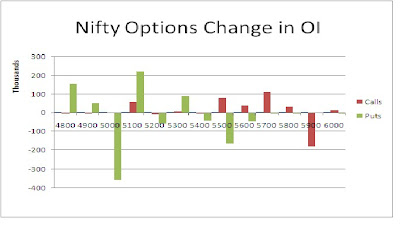

The Nifty option OI Charts are given below:

There was very little addition of open interest done by both, the Bulls and the Bears on Friday. Overall, the Option Charts indicate strong support for Nifty at 5300 and 5200 levels. 5600 CE strike has the maximum open interest in Calls, however, it is not of such big volume so as to be considered as a major resistance as of now. 5300 to 5600 is the indicated range from the Option Charts, with 5400 and 5500 as the battleground level for the Bulls and the Bears.

There was very little addition of open interest done by both, the Bulls and the Bears on Friday. Overall, the Option Charts indicate strong support for Nifty at 5300 and 5200 levels. 5600 CE strike has the maximum open interest in Calls, however, it is not of such big volume so as to be considered as a major resistance as of now. 5300 to 5600 is the indicated range from the Option Charts, with 5400 and 5500 as the battleground level for the Bulls and the Bears.For Monday, immediate resistance for Nifty Spot comes at 5365/5370 levels. Above this, it ill head for 5395 levels and then towards 5425/5430level. The Bears are expected to offer stiff resistance at 5400+ levels. Still, if nifty is able to sustain and close above 5400, then this short term correction can be considered to be over. On the downside, support for Nifty Spot comes at 5320/5325 levels. Below this, the Bears will have an upper hand, and they will push nifty down to test lower levels of 5290/5250 levels.

5 March - Nifty Spot resistance at 5370-5395-5425-5460. Support at 5320-5290-5250-5220 - www.niftypower.com

Nifty Tips - Nifty Future Tips and Nifty Option Tips

No comments:

Post a Comment