Nifty had another Gap Up on Wednesday, but faced stiff resistance in our resistance zone of 5490/5500 and sold off to fill the gap in in intraday trades, before finally closing in the positive. Positional longs can now increase their stoploss to 5350 level, and should reverse to Shorts if this level is breached. We are heading into the budget and some volatility can be expected. On the upside, the zone of 5490/550 is the immediate resistance, above which another 100 point rally can come.

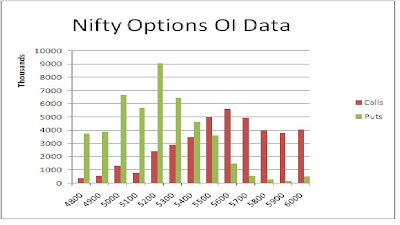

The Nifty option OI Charts are given below:

On the Options front, the Bulls seems to be getting over confident. A huge 34 lacs+ OI was added by the Bulls from 5000 PE to 5500 PE strikes. Such a big move ahead of the volatile session of the budget indicated that the Bulls expect good news from the budget. The Bears were subdued and not much action was seen today in Call options. overall, 5400 and 5500 has become the battle ground levels between the Bulls and the Bears. 5300 and 5200 are the major support levels, while 5600 is the biggest resistance level for this series.

On the Options front, the Bulls seems to be getting over confident. A huge 34 lacs+ OI was added by the Bulls from 5000 PE to 5500 PE strikes. Such a big move ahead of the volatile session of the budget indicated that the Bulls expect good news from the budget. The Bears were subdued and not much action was seen today in Call options. overall, 5400 and 5500 has become the battle ground levels between the Bulls and the Bears. 5300 and 5200 are the major support levels, while 5600 is the biggest resistance level for this series.For tomorrow, immediate resistance for Nifty Spot again comes at 5490-5500 zone. Above this, a 100 point short covering rally can come, with minor resistance at 5555 level. On the downside, support for Nifty Spot comes at 5440 level, below which, it can slide towards 5420, 5385 and 5345 levels. A move below 5345 will be Bearish for the short term.

15 Mar - Nifty Spot resistance at 5495-5515-5555-5590. Support at 5440-5420-5385-5345 - www.niftypower.com

Nifty Tips - Nifty Future Tips and Nifty Option Tips

No comments:

Post a Comment