Nifty opened gap up on Monday, but could not support the gains and fell below 5380 in the first five minutes itself, and thereafter, struggled to cross it for the entire day. On the downside, it found support in our support zone of 5320-5325 and bounced back from there. If it gives a close below this zone now, positional shorts can be opened with a 50 point stoploss. On the upside, a breakout can happen if Nifty Spot is able to sustain above 5380/5390 zone. Hence, positional Longs can be taken if it sustains above this zone. Do remember that we are heading into the budget, and volatility will be the order of the day. Hence, trade with strict stop and reverse method for the time being.

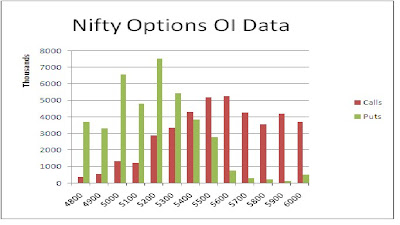

The Nifty option OI Charts are given below:

As we near the volatile times of budget days, the Option writers seems to have gone into hibernation for the time being. From the Bulls, there was a good amount of profit booking at 5300 PE strike, which reduced its OI by 6 lacs+. Also, they added a small amount 4 lacs+ OI at 5400 PE strike. The Bears added a small quantity 3 lacs+ OI at 5500 CE strike. Apart from that, some activity was seen at faraway strikes, which is better to ignore for the time being. Overall, the Option Charts show 5400 as the 50:50 level ahead of the budget. Below that, 5300 is a minor support, while 5400 is a major support level for this series. On the upside, 5500 is a minor resistance, while 5600 is the major resistance for this series.

As we near the volatile times of budget days, the Option writers seems to have gone into hibernation for the time being. From the Bulls, there was a good amount of profit booking at 5300 PE strike, which reduced its OI by 6 lacs+. Also, they added a small amount 4 lacs+ OI at 5400 PE strike. The Bears added a small quantity 3 lacs+ OI at 5500 CE strike. Apart from that, some activity was seen at faraway strikes, which is better to ignore for the time being. Overall, the Option Charts show 5400 as the 50:50 level ahead of the budget. Below that, 5300 is a minor support, while 5400 is a major support level for this series. On the upside, 5500 is a minor resistance, while 5600 is the major resistance for this series.For tomorrow, immediate resistance for Nifty Spot comes at comes at 5370/5395 zone. Above this, the Bears can run for cover, which can take nifty towards higher levels of 5425-5460 levels. On the downside, support for Nifty Spot comes at 5340 and then at 5325/5320 levels. Below this, the Bears will have an upper hand, and Nifty Spot will slide further towards 5290-5250 and 5220 levels.

13 Mar - Nifty Spot resistance at 5370-5395-5425-5460. Support at 5340-5320-5290-5250 - www.niftypower.com

Nifty Tips - Nifty Future Tips and Nifty Option Tips

No comments:

Post a Comment