On Wednesday, it was another day when Nifty threatened to break the 200 DMA support, but managed to save it and closed above it. Thursday is Expiry day. A close below the 200 DMA will change the medium/ long term trend to negative. Short term trend is anyway negative. On the upside, if it moves up and manages to close above 5290 now, the short term bias will change to UP. Till then, trading is going to be choppy within this 150 point range.

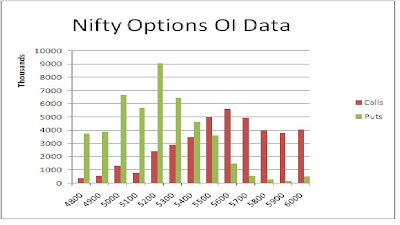

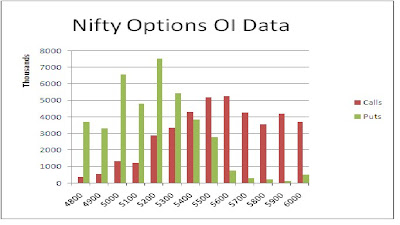

On Wednesday, it was another day when Nifty threatened to break the 200 DMA support, but managed to save it and closed above it. Thursday is Expiry day. A close below the 200 DMA will change the medium/ long term trend to negative. Short term trend is anyway negative. On the upside, if it moves up and manages to close above 5290 now, the short term bias will change to UP. Till then, trading is going to be choppy within this 150 point range.The Nifty option OI Charts are given below:

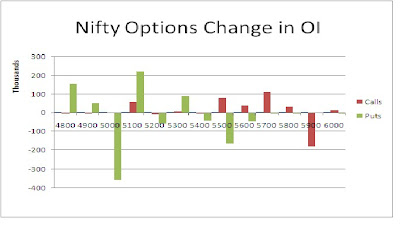

One day before the expiry, not much addition in OI should be expected. That was the case on Wednesday. On a down day, the Bulls mainly covered their positions at 5200 CE to 5400 CE strikes, reducing the open interest by 31 lacs+. On the other hand, the Bulls did nothing much except for addition of a big 13 lacs+ OI at 5300 CE strike. Overall, on Expiry day, 5200 is going to be the battleground level between the Bulls and the Bears.

One day before the expiry, not much addition in OI should be expected. That was the case on Wednesday. On a down day, the Bulls mainly covered their positions at 5200 CE to 5400 CE strikes, reducing the open interest by 31 lacs+. On the other hand, the Bulls did nothing much except for addition of a big 13 lacs+ OI at 5300 CE strike. Overall, on Expiry day, 5200 is going to be the battleground level between the Bulls and the Bears.For Thursday, immediate resistance for Nifty Spot comes at 5220/5225 Spot levels. Above this, the intraday trend can be considered to be positive, and the Bulls will attempt to change the short term trend to UP by closing above 5270/5280 range. On the downside, immediate support for Nifty Spot comes at 5165 and then at 5130 level. A close below 5130, will turn the medium/long term trend to Down, and the Bulls will fight fiercely to save this level.

29 Mar - Nifty Spot resistance at 5220-5245-5275-5295. Support at 5165-5130-5070-5050 - www.niftypower.com

Nifty Tips - Nifty Future Tips and Nifty Option Tips