On Monday, Nifty finally corrected a bit and fell below its support level of 5735, crashing to 5666 in intraday trade, just next to our last support level of 5660, and closed around 5672 level. From the time this rally has started, this is the first time that Nifty has broken a breakout support level. Hence, it is fair to expect this correction/ consolidation to last a bit longer than the previous ones. The short term trend should be considered down till the time Nifty Spot stays below 5735/5750 Spot level now. Positional Shorts have been triggered, and downside levels to keep an eye will be 5660 and 5630/5625 levels. Below 5630, it has the potential to reach 5560/5550 level. On the upside, 5735/5750 should offer stiff resistance now, and should be Stop and Reverse Level for Shorts on closing basis.

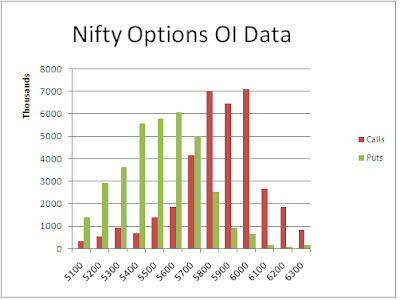

On the Options front, the Bars dominated again today, adding 22 lacs+ OI from 5700 CE to 6000 CE strikes. On the other hand, the Bulls were active at 5600 PE and 5400 PE, where they added 6 lacs+ OI each. Overall, 5700 has now become the 50:50 level between the Bulls and the Bears. 5800 and 6000 are the major resistances for Nifty in this series.On the downside, support exists at 5600 and below levels.

For tomorrow, immediate resistance for Nifty Spot now comes at 5690/5695 levels. If stays above this, then the Bulls will try a retest of 5715/5735 zone, where again Selling pressure is expected to come. On the downside, support for Nifty Spot comes at 5660 levels. Below this, the Nears will continue to have an upper hand, and they can drag Nifty toward 5630/5625 and 5605 levels. If breaks 5600, then 5560/5555 can come quickly.

9 Oct - Nifty Spot resistance at 5695-5715-5735-5750. Support at 5660-5625-5605-5560 - www.niftypower.com

Visit here for Nifty Tips - Nifty Future Tips and Nifty Option Tips

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

No comments:

Post a Comment