On Monday, Nifty opened down, but recovered intraday to once again get resisted at 5690/5695 level, and closed very near to it. For the past two trading days, Nifty has traded within the range of Thursday. It has defined a clear trading range of 5630 to 5730/5735. Any Breakout/ Breakdown from this range can give the next quick move of 100+ points. Hence, Positional traders can either continue to hold shorts with stop and reverse around 5735 Nifty Spot, or sit out and wait for the breakout/ breakdown to happen. Intraday traders can continue to make merry till Nifty is within the range, and trade with a combination of support and resistances, along with oscillators like Stochastics and RSI.

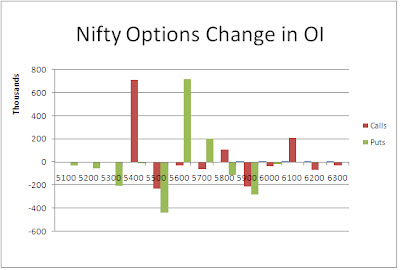

The Nifty Option OI Charts are given below:

In Nifty Options, the Bulls strengthened their positions at 5600 level, by adding 7 lacs+ OI at 5600 PE strike. On the other hand, the Bears added a similar amount of OI, but at a surprisingly lower level of 5400 PE strike. Overall, 5800 and 5900 remain as towering resistances for this series, with open interest in 5800 and 5900 CE strikes near a huge 90 lacs each. 5700 remains the 50:50 level, with almost equal open interest. 5600 and below are the supports as of now.

For tomorrow, immediate resistance for Nifty Spot comes at 5690/5695 levels. Above this, the Bulls will again try to take it towards higher level resistances of 5715/5735 and 5750 level. On the downside, support for Nifty Spot comes around 5660/5650 level. Below this, the Bears will have an upper hand, and they will try and take Nifty to retest its support level of 5630/5625 and 5605 levels. Below 5630, the Bears will be in control and there can be some panic selling in Nifty.

16 Oct - Nifty Spot resistance at 5695-5715-5735-5755. Support at 5655-5630-5605-5585 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

The Nifty Option OI Charts are given below:

In Nifty Options, the Bulls strengthened their positions at 5600 level, by adding 7 lacs+ OI at 5600 PE strike. On the other hand, the Bears added a similar amount of OI, but at a surprisingly lower level of 5400 PE strike. Overall, 5800 and 5900 remain as towering resistances for this series, with open interest in 5800 and 5900 CE strikes near a huge 90 lacs each. 5700 remains the 50:50 level, with almost equal open interest. 5600 and below are the supports as of now.

For tomorrow, immediate resistance for Nifty Spot comes at 5690/5695 levels. Above this, the Bulls will again try to take it towards higher level resistances of 5715/5735 and 5750 level. On the downside, support for Nifty Spot comes around 5660/5650 level. Below this, the Bears will have an upper hand, and they will try and take Nifty to retest its support level of 5630/5625 and 5605 levels. Below 5630, the Bears will be in control and there can be some panic selling in Nifty.

16 Oct - Nifty Spot resistance at 5695-5715-5735-5755. Support at 5655-5630-5605-5585 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

No comments:

Post a Comment