Nifty formed a Doji on Daily Charts today, after having a rangebound day again. In the past two days, it has formed a narrow trading between 4725 and 4785. A breakout from this range should give the next directional move. Till then, it is better to trade intraday for small gains. Below 4725, 4690 and 4635 are the support levels to watch and confirm the breakdown. Similarly, above 4785, the levels of 4805 and 4850 would be the next resistances to watch, for confirmation of the breakout.

Nifty formed a Doji on Daily Charts today, after having a rangebound day again. In the past two days, it has formed a narrow trading between 4725 and 4785. A breakout from this range should give the next directional move. Till then, it is better to trade intraday for small gains. Below 4725, 4690 and 4635 are the support levels to watch and confirm the breakdown. Similarly, above 4785, the levels of 4805 and 4850 would be the next resistances to watch, for confirmation of the breakout.The Nifty option OI Charts are given below:

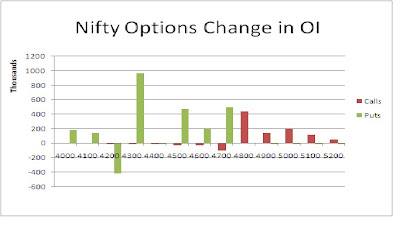

It was a nothing day for Option writers as well. The Bulls added a small amount of OI at 4500 PE and 4700 PE strikes. Similarly, the Bears added a small amount at 4800 CE and above strikes. Overall, the range as per the Options Charts remains the same as yesterday. 4500 to 5000 is the broad range as per the Options Charts. 4600 to 4900 is a narrower range, with 4700 as a minor support, and 4800 as a minor resistance.

It was a nothing day for Option writers as well. The Bulls added a small amount of OI at 4500 PE and 4700 PE strikes. Similarly, the Bears added a small amount at 4800 CE and above strikes. Overall, the range as per the Options Charts remains the same as yesterday. 4500 to 5000 is the broad range as per the Options Charts. 4600 to 4900 is a narrower range, with 4700 as a minor support, and 4800 as a minor resistance.For tomorrow, immediate resistance for Nifty Spot comes at 4755/4760 levels. Above this, it will test the upper end of the range at 4785. Above 4785, lot of Long traders will jump in to take Nifty to higher levels of 4805 and 4850. on the downside, support for Nifty Spot comes at 4725/4720 levels. Below this, Bears will have an upper hand, and they will try and push Nifty towards lower levels of 4690 and 4635. Tomorrow, if Nifty gives a breakout from the range of 4725 to 4785, then trade in the direction of the breakout with a tight 20-30 point stoploss.

6 Jan - Nifty Spot resistance at 4760-4785-4805-4850. Support at 4725-4690-4660-4635 - www.niftypower.com

Visit here for Intraday Nifty Tips

No comments:

Post a Comment