On Monday, nifty once again closed in the 4740-4760 band. Today was the sixth consecutive day when Nifty closed within this narrow band. Intraday it has been volatile, but for Positional Traders, it has not done anything for the past six days. This might be a sign for a big move soon. Positional traders should initiate a trade on the breakout from the range of 4690 to 4805, with a tight Stop and Reverse of 20 points. For Options traders, they can buy a straddle of 4700 CE and 4700 PE, and hold till Friday to see if the breakout happens.

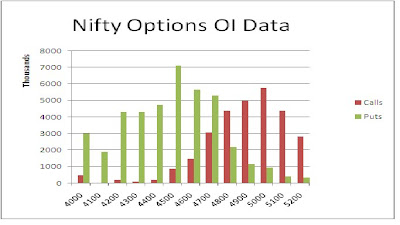

On Monday, nifty once again closed in the 4740-4760 band. Today was the sixth consecutive day when Nifty closed within this narrow band. Intraday it has been volatile, but for Positional Traders, it has not done anything for the past six days. This might be a sign for a big move soon. Positional traders should initiate a trade on the breakout from the range of 4690 to 4805, with a tight Stop and Reverse of 20 points. For Options traders, they can buy a straddle of 4700 CE and 4700 PE, and hold till Friday to see if the breakout happens.The Nifty option OI Charts are given below:

In the ITM Options, it was the Bears who dominated today, adding 8 lacs+ OI at 4800 CE and 4900 CE strikes. The Bulls did not do much at the near strike options. After todays move, 4600 to 4900 is the narrow range as per the Options Charts. 4700 is a minor support and 4800 is a minor resistance. A breakout from the minor supports/ resistances can easily give the next 100 point move. 4500 to 5000 is the larger range as per the Options Charts.

In the ITM Options, it was the Bears who dominated today, adding 8 lacs+ OI at 4800 CE and 4900 CE strikes. The Bulls did not do much at the near strike options. After todays move, 4600 to 4900 is the narrow range as per the Options Charts. 4700 is a minor support and 4800 is a minor resistance. A breakout from the minor supports/ resistances can easily give the next 100 point move. 4500 to 5000 is the larger range as per the Options Charts.For tomorrow, immediate resistance for Nifty Spot comes at 4755/4760 levels. Above this, it will head for next resistance levels of 4785 and 4805 levels. Above 4805, sharp upmove can be seen towards 4845/4850 levels. On the downside, immediate support for Nifty Spot comes at 4720 levels, below which 4690 is the next support level. As given earlier, below 4690, it will be a breakdown from the range with next major support coming around 4635 levels.

10 Jan - Nifty Spot resistance at 4755-4785-4805-4845. Support at 4720-4690-4660-4635 - www.niftypower.com

Visit here for Nifty Future Tips and Nifty Option Tips

No comments:

Post a Comment