The expected correction came came in Nifty today. How long it lasts, and whether it can change into a short term downtrend remains to be seen. The level to watch out for tomorrow will be 5040-5060 levels. Below this, the short term trend can be considered to have turned down, which will be invalidated only on a close above 5150. Tomorrow is also the monthly closing for Nifty. Hence, tomorrow's closing will become an important level for future trade plans. Nifty has already made a higher High in this uptrend move, Now all it has to do is make a higher low in this ongoing correction, so that the medium term trend remains up.

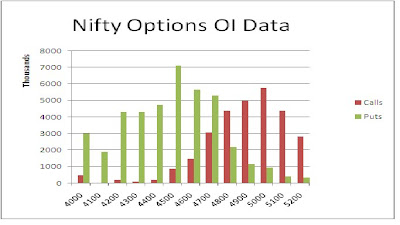

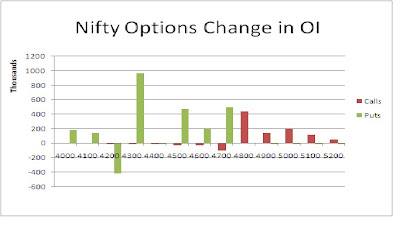

The Nifty option OI Charts are given below:

It was a day that belonged to the Bears. They added 18 lacs+ OI at 5100 CE and 5200 CE strikes. The Bulls did little addition in OI. The covered nearly 13 lacs OI at 4800 PE, 4900 PE and 5000 PE strikes. Although Nifty closed below 5100 level, the open interest in 5100 PE remains more than that of 5100 CE. Consider the momentum positive if Nifty stays above 5100, and negative below that. The narrow range remains at 5000 to 5200 for Nifty, with 5100 as the 50:50 level.

It was a day that belonged to the Bears. They added 18 lacs+ OI at 5100 CE and 5200 CE strikes. The Bulls did little addition in OI. The covered nearly 13 lacs OI at 4800 PE, 4900 PE and 5000 PE strikes. Although Nifty closed below 5100 level, the open interest in 5100 PE remains more than that of 5100 CE. Consider the momentum positive if Nifty stays above 5100, and negative below that. The narrow range remains at 5000 to 5200 for Nifty, with 5100 as the 50:50 level.For tomorrow, immediate resistance for Nifty Spot comes at 5095/5100 levels. Above this, it will encounter next resistance at 5130 and 5160 levels. Above 5160, the momentum will again favour the Bulls. On the downside, support for Nifty Spot comes at 5065 and then at 5040/5045 levels. Below 5040, the short term trend will turn down.

31 Jan - Nifty Spot resistance at 5095-5130-5155-5190. Support at 5065-5040-5005-4960 - www.niftypower.com

Nifty Tip - Nifty Future Tip and Nifty Options Tips