Today, Nifty traded rangebound for most of the day, took support at our first support of 5100 (actual low of 5098), before breaking out of first resistance 5145, to make an intraday high of 5169. It could not cross above the strong resistance zone of 5180-5230. This zone of 5180 to 5230 will be the most crucial, if Nifty has to continue this uptrend. Once this zone is crossed, traders can safely keep a stop and reverse below 5180 and enter fresh longs. However, the Risk: Reward favors shorts as of now, as we approach this zone. The Option Charts will give us more clues.

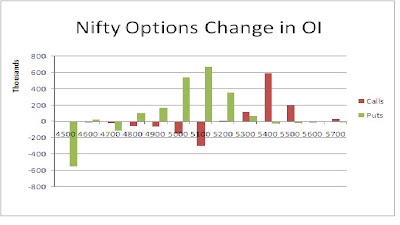

The Nifty Option Open Interest charts are given below:

First lets look at the unusual data. The Puts added yesterday at 4500 PE levels were covered today. Almost an equal amount of Call were added at 5400 CE today. If Nifty moves down tomorrow, then we will have a pattern in these addition of OI at deep OTM Options. Apart from that, the Bulls added big amount of OI at 5000 PE to 5200 PE strikes. The Bears on the other hand, did not do much today also. Overall, the range as per the Options table is 4900 to 5200, with 5000 being a minor support and 5100 being the 50:50 level between the Bulls and the Bears.

For tomorrow, immediate resistance for Nifty Spot now comes at 5180-5200 level. If it manages to sustain above this, it will target the gapdown level of 5225/5230. Above 5230 till the gap level of 5325, anything can happen, and will have to be keenly watched. Above that zone, it will be a good idea to go for an Option straddle, as volatility can increase. On the downside for tomorrow, immediate support for Nifty Spot comes at 5125-5130 levels. If sustains below these, it will move lower 5110-5080-5065 and 5035 level.

9 Sep: Nifty Spot resistance at 5180-5200-5230-5260. Support at 5130-5110-5080-5065 - www.niftypower.com

Visit here for Intraday Nifty Tips

No comments:

Post a Comment