In Yesterday's Nifty View, it was written to Sell on all Rallies till Nifty stays below 5030/5050. Today, it made a high of 5030, and then had a furious sell-off of 100+ points, marking a low near our second support. Staying with the trend always pays off well. The resistance zone of 5030-5050 is the immediate short term trend deciding level as of now. Till Nifty stays and trade below these levels, consider the trend to be down. And as always, dont look for supports in a Down market. Look out for resistances to Sell, till the reference level is not breached.

In Yesterday's Nifty View, it was written to Sell on all Rallies till Nifty stays below 5030/5050. Today, it made a high of 5030, and then had a furious sell-off of 100+ points, marking a low near our second support. Staying with the trend always pays off well. The resistance zone of 5030-5050 is the immediate short term trend deciding level as of now. Till Nifty stays and trade below these levels, consider the trend to be down. And as always, dont look for supports in a Down market. Look out for resistances to Sell, till the reference level is not breached.The Nifty option Open Interest charts are given below:

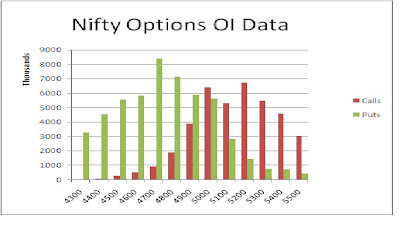

The Bulls did not do much today, except for a small addition at 4700 PE strike. The Bears on the other hand, came in full force today, adding 23 lacs+ OI at 5000 CE to 5200 CE strikes. The range as per the Options table is 4800 to 5200, with 4900 as a minor support and 5100 as a minor resistance. 5000 is the 50:50 level as of now, and is acting as a pivot between 4940 and 5040. Break of this 100 point range, with corresponding change in OI Data, would give an early indication of the coming move in Nifty.

The Bulls did not do much today, except for a small addition at 4700 PE strike. The Bears on the other hand, came in full force today, adding 23 lacs+ OI at 5000 CE to 5200 CE strikes. The range as per the Options table is 4800 to 5200, with 4900 as a minor support and 5100 as a minor resistance. 5000 is the 50:50 level as of now, and is acting as a pivot between 4940 and 5040. Break of this 100 point range, with corresponding change in OI Data, would give an early indication of the coming move in Nifty.For tomorrow, immediate support for Nifty Spot comes at 4935-4940 level. If it trades below these, it will revisit todays lows and then lower supports of 4885-4855. On the upside, resistance for Nifty Spot comes around4985-4990 level. Above this, it will again make an attempt towards 5030-5050 levels. As given earlier also, breakout above 5050 would turn the short term trend to upside. Till then Sell the Rallies.

14 Sep: Nifty Spot resistance at 4985-5010-5030-5050. Support at 4935-4905-4885-4855 - www.niftypower.com

Visit here for Nifty Option Tips

No comments:

Post a Comment