We have reached the expiry of a highly volatile series, which largely traded within a band of 400 points. Nifty closed near the middle of this band just one day before the expiry. 4905 and 4980 seem to be the imemdiate narrow range within the broad band of 4800 and 5200. Breakout from the immediate resistance/ support levels will give the first direction of intended move. Since today the technicals dont matter much, the breakout, if it happens today, should be confirmed by a follow-up move tomorrow.

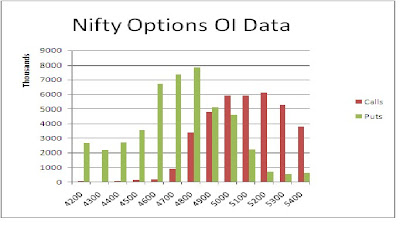

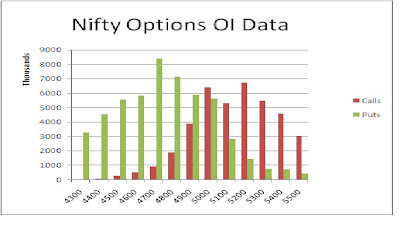

We have reached the expiry of a highly volatile series, which largely traded within a band of 400 points. Nifty closed near the middle of this band just one day before the expiry. 4905 and 4980 seem to be the imemdiate narrow range within the broad band of 4800 and 5200. Breakout from the immediate resistance/ support levels will give the first direction of intended move. Since today the technicals dont matter much, the breakout, if it happens today, should be confirmed by a follow-up move tomorrow.The Nifty option Open Interest charts are given below:

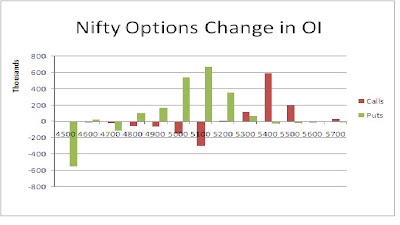

As is expected before the expiry, there was covering at almost all the strikes, except for some addition at 4900 CE and 5000 CE by the Bears. This is similar to the exuberance exhibited by the Bulls yesterday. Their exuberance backfired. Will the same happen to the Bears today? Overall, 4900 and 5000 are the two 50:50 levels as per the Option Charts. This is also in line with our immediate breakout levels as given above. 4800 to 5100 is the range.

As is expected before the expiry, there was covering at almost all the strikes, except for some addition at 4900 CE and 5000 CE by the Bears. This is similar to the exuberance exhibited by the Bulls yesterday. Their exuberance backfired. Will the same happen to the Bears today? Overall, 4900 and 5000 are the two 50:50 levels as per the Option Charts. This is also in line with our immediate breakout levels as given above. 4800 to 5100 is the range.For tomorrow, immediate resistance for Nifty Spot comes at 4955/4960 levels. Trading above this, it will target the breakout level of 4980, and then towards 5000-5030-5060. On the downside, immediate support for Nifty Spot comes at 4915/4910 levels. Below this, Bears will try to break 4900 for lower levels of towards 4830.

29 Sep: Nifty Spot resistance at 4955-4980-5030-5060. Support at 4915-4880-4860-4830 - www.niftypower.com

Visit here for Intraday Nifty Tips