On Tuesday, Nifty opened flat, and after a few hours of rangebound trading, broke out to make new highs, and close very near to its resistance area of 6050 Spot. If we see last week's movement in Nifty, it declined to close the Gap created on 2nd Jan, and also tested the breakout level of 5945. Thereafter, it closed above 6020 on Monday, and has now closed well above it. Hence, the short term trend remains up. The first signal of this upward momentum waning will be when Nifty gives a close below 6020 Spot. This can now be the stoploss for aggressive trades in Long positions. This is also the level, below which aggressive Shorts can be opened. Although there has not been any significant correction in this upmove, the upward momentum has also been lacking. Also, there is a clear negative divergence on Daily charts. Hence, even in Long positions, it is better not to go all out, and trade carefully. For Short positions, wait for a break and close below 6020. Real downward momentum is expected only when Nifty declines below 5980 and then 5940 levels.

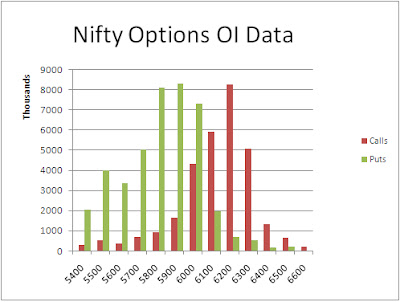

The Nifty Option OI Charts are given below:

On the Nifty Options front, the Bears added a huge quantity of 13 lacs+ open interest at 6000 PE strike. On the other hand, the Bears primarily covered some of their positions from 5900 CE to 6200 CE strike. Overall, there is no 50:50 level right now, as per the Nifty Option charts. 6000 is a minor support, and 6100 is a minor resistance. The major support is at 5900 and major resistance is at 6200, with Open Interest at these strikes crossing 80 lacs+ as of now.

For Wednesday, immediate resistance for Nifty Spot comes at 6050/6055 levels. Staying above this, the Bulls will remain in control, and will take Nifty higher towards its next resistance zone of 6075/6095. Above 6095, 6120 and then 6160/6170 levels can come quickly. on the downside, support for Nifty Spot now comes at 6020 levels. If declines below this, the Bears will press hard for lower level of 6005-5980 and 5960/5940. Below 5940, panic selling is expected.

16 Jan - Nifty Spot resistance at 6055-6075-6095-6120. Support at 6020-6005-5980-5960 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily

Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see

Rates and Services Page on www.niftypower.com