On Thursday, Nifty opened flat, but rose in intraday trade to close near 6040 levels. On Wednesday Nifty closed below 6020, triggering aggressive positional shorts. These shorts can now keep a Stoploss above today's high near 6055 levels. The breakdown trade as failed on the downside, and the opposite trade can bring swift movement. Hence, it is better to keep a tight stoploss. As long as Nifty trades above 6020 spot, the momentum will lie with the Bulls. If it again falls below that levels, once again aggressive short trades can be taken with same stoploss. But for now, Buy above 6055, Sell below 6020, and trade intraday in between sould be the trading strategy.

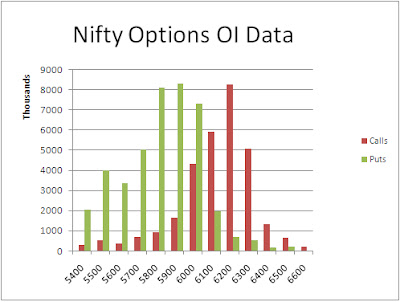

The Nifty Option OI Charts are given below:

On The Nifty Options front, the Bulls added a huge quantity of 20 lacs+ in Nifty Option strikes of 5900 PE to 6000 PE. On the other hand, the Bulls did not do any addition, but covered small positions in 6100 CE and above strikes. Overall the picture remains the same in Nifty Option Charts. There is no 50:50 level, 6000 is a minor support and 6100 is a minor resistance. The major support is at 5900 and major resistance is at 6200, with Open Interest at these strikes crossing 80 lacs+ as of now.

For tomorrow, immediate resistance for Nifty Spot now comes at 6050-6055 levels. This is the level where it has been facing resistance for the past two days. Staying above this, the Bulls will take Nifty towards it next resistance zone of 6075-6095. Above 6095, 6120 and then 6160/6170 levels can come quickly. On the downside, support for Nifty Spot now comes at 6020 levels. If declines below this, the Bears will press hard for lower level of 6005-5980 and 5960/5940. Below 5940, panic selling is expected.

18 Jan - Nifty Spot resistance at 6055-6075-6095-6120. Support at 6020-6005-5980-5960 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

No comments:

Post a Comment