On Friday, Nifty formed and Inside Day on Daily charts, by trading within the range of Thursday, and closing near 5908 level. Monday is the monthly close, as well as the yearly close for Nifty. Whether it breaks out of the 100 point one, within which it has been trading for entire December, remains to be seen. Till that happens, Nifty View for traders remains the same. Positional traders can either wait for a breakout, or trade the zone of 5840 to 5940, buying near the low and selling near the high, with a 20 point Stoploss and Reverse trade.

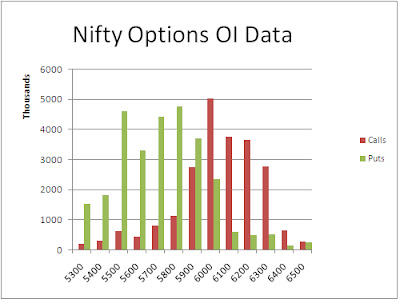

The Nifty Option OI Charts are given below:

In Nifty Options, it was the first day of the series, and as is expected, there was good amount of open interest addition by the Bulls. The Bulls added a huge quantity of 35 lacs+ open interest in Nifty option strikes of 5600 PE to 5900 PE. On the other hand, the Bears were a little subdues, and added only around 16 lacs+ open interest at Nifty Option strikes of 6100 CE and 6200 CE.Overall, at the start of the series, the Nifty Option charts look very similar to the December series, with 5900 as the 50:50 level, and 5800 and 6000 as support and resistance levels.

For Monday, immediate resistance for Nifty Spot comes at 5905/5910 level. Staying above this, the Bulls will try for higher level resistances of 5930 and 5945. Above 5945, it will be breakout and we can witness a short covering rally till 5990 and 6020 levels. On the downside, support for Nifty Spot comes at 5890 level. Below this, the Bears will continue to have an upper hand, and they will push Nifty down towards 5870/5850 and 5835 levels.

31 Dec - Nifty Spot resistance at 5905-5930-5945-5990. Support at 5890-5870-5850-5835 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

No comments:

Post a Comment