On Thursday, Nifty opened down on negative global cues, moved further down to test its support level at 5600, before recovering slightly and closed right at the important level of 5630 Spot. The Bears have been trying hard to break below this level, but haven't succeeded till now. It hangs in balance as of now, and tomorrow may be a crucial day to decide further movement in Nifty. The expected move is down, and traders who are holding short positions can move their stoploss above 5690 Nifty Spot level. If the Bulls manage to pull Nifty back from here, then a higher bottom would have formed on short term charts, which will be a good structure for a rally to unfold. Hence, traders who are short can keep a Stop and Reverse at around 5690/5695 Nifty Spot level on closing basis.

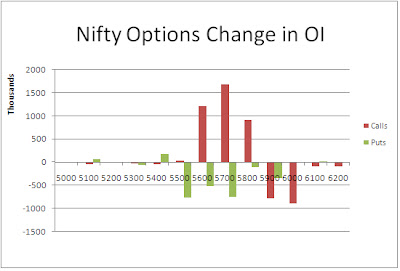

The Nifty Option OI Charts are given below:

On the Options front, it was the Bears day all the way. They added a huge quantity of 38 lacs+ OI from 5600 CE to 5800 CE strikes. On the other hand, the Bulls covered a large amount of 20 lacs+ OI from 5500 PE to 5700 PE strike. After today's move, 5600 still is a good support for Nifty, but the Bears have dented it a little. 5700 is minor resistance level now, while 5800 is the towering resistance for this series.

For tomorrow, immediate resistance for Nifty Spot comes at 5630/5635 level. Staying above this, the Bulls will try and pull Nifty higher towards 5660 and 5680/5690 level. Above 5690, we can see some panic short covering from the Bears. On the downside, support for Nifty Spot comes around 5605 level. Below this, it can slide towards its recent low of 5585/5580, below which, lies the gap support of 5530/5525.

16 Nov - Nifty Spot resistance at 5635-5660-5685-5705. Support at 5605-5585-5560-5525 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

No comments:

Post a Comment