On Friday, Nifty opened down on negative global cues, but recovered smartly to close the gap by day end. Overall, it was a positive week for Nifty, and it maintained its uptrending move. It has closed all the recent Gaps, except the one that was formed on 12th July. That zone of 5260/5270 to 5300/5310 remains a stiff resistance, and Nifty has been unable to cross it despite some very positive global cues. Next week, it is again set to test this resistance zone. How it behaves when it reaches that zone, the volumes and the Options open interest, will give further clues for the next big move.

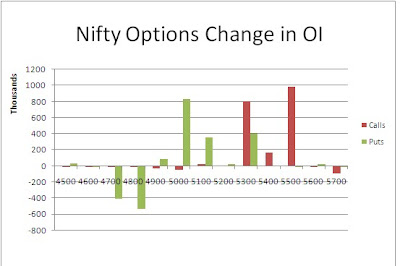

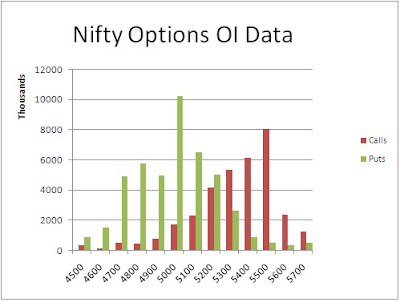

The Nifty Option OI Charts are given below:

On the Options front, there was little activity on Friday. Bulls were mainly active at 5000 PE strike, while the Bears were active at 5300 CE and 5500 CE strikes. Overall, 5000 still stands tall as the biggest support for this series also. 5500 is the biggest resistance. 5200 to 5400 is the minor range, within which Nifty is trading right now.

On the Options front, there was little activity on Friday. Bulls were mainly active at 5000 PE strike, while the Bears were active at 5300 CE and 5500 CE strikes. Overall, 5000 still stands tall as the biggest support for this series also. 5500 is the biggest resistance. 5200 to 5400 is the minor range, within which Nifty is trading right now.For Monday, immediate resistance for Nifty Spot comes around 5230 and then at 5260 levels. As given earlier, the zone of 5260/5270 to 5300/5310 is the toughest resistance for Nifty Spot. A close above this zone is needed for larger rallies. On the downside, support for Nifty Spot comes at 5190 and then around /5170 level. Below 5170, the Bears will get an upper hand, and they will take Nifty down towards 5150 and 5100 level.

6 Aug - Nifty Spot resistance at 5230-5260-5300-5320. Support at 5190-5170-5150-5100 - www.niftypower.com

Visit here for Nifty Tips - Nifty Future Tips and Nifty Option Tips

No comments:

Post a Comment