On Tuesday, two days before Expiry of the August series, Nifty has closed below a crucial support level of 5340/5345 Spot. With this, the short term trend can be considered to have turned down. The oscillators are also now in overbought position and point to a pending downward move. However, the downward momentum was missing after the break of 5345, and it will be prudent for Positional Traders to initiate short positions in stages - some part now, and some part on further break and close below 5290 Spot. The trend is down and long positions should be avoided till Nifty gives a close above 5415/5430 as of now. The levels to watch in between will be 5345 and 5380/5385 Spot. If Nifty does not give a follow through movement below 5345, and infact, is able to move above 5345/5385, then this Expiry will be a rangebound one. A move above 5415, on the other hand, will make this downmove a false breakdown and a shake out move for the Bears. Such a move usually brings a fierce move in the opposite direction. However, we will think about it when such move comes. As of now, the trend is down, and that is what should be the direction of trades.

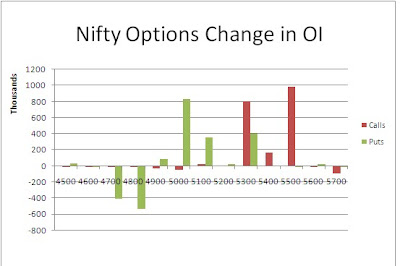

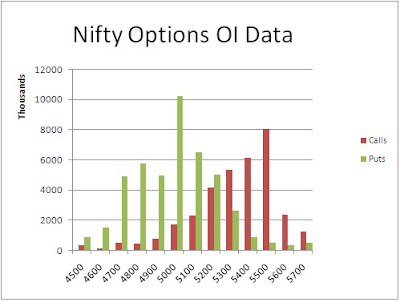

The Nifty Option OI Charts are given below:

On the Options front, not much is expected so close to the Expiry. However, there was a surprisingly high addition of 10 lacs+ OI at 5200 PE by the Bulls and an even more surprisingly high 18 lacs+ OI at 5400 CE by the Bears. 5300 to 5500 has been the range for this month as per the Option charts. Two days before Expiry, the Option seem to want to shift this range down. Overall, the Option charts indicate supports at 5300 and below levels, while resistances at 5400 and above levels. Looking at the Option charts, it looks like the Option writers are betting on an expiry between 5300 and 5400 for Nifty. Any move beyond this range, and we can see some panic from the losing camp.

For Wednesday, immediate resistance for Nifty Spot now comes at 5340/5345 Spot. Above this, the Bulls will try and take it higher towards 5380, 5400 and 5420 levels, where again some selling pressure is expected. On the downside, support for Nifty Spot comes around 5320/5315 levels. Below this, the Bears will try to push it towards its support level of 5295 and 5260 spot. Below 5260, Gap filling till 5215 level can occur.

29 Aug - Nifty Spot resistance at 5345-5380-5400-5420. Support at 5315-5295-5260-5215 - www.niftypower.com

Visit here for Nifty Tips - Nifty Future Tips and Nifty Option Tips