Nifty opens after a 4 day long weekend on Monday. Last week was a low volume traded week, and movement was also lackluster on almost all the 3 trading days. Next week, the volumes are expected to improve, and we might get a trending move. The narrow range of last week has also opened up trading opportunities with small stoploss. On the downside, 5290/5270 is the zone to watch. A closing below this zone will turn the short term momentum down, which can go on to close the gap formed on 30th March. On the upside, Nifty has been forming a pattern of Lower highs and Lower lows on Daily Charts. Till the time it keeps below the falling trendline, the Bias of positional traders should be Bearish. Above this falling trendline, the Bearish pattern will be invalidated, and may signal an end of this correction for New Highs.

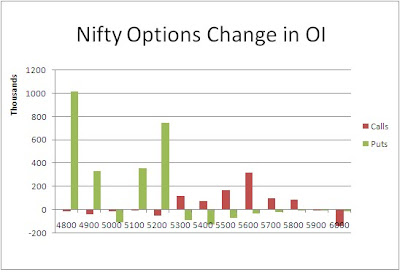

The Nifty option OI Charts are given below:

Friday was a nothing day from the Option Writers, except for addition of 11 lacs+ OI at 5100 PE and 5200 PE by the Bulls. At the beginning of the April series, the Option charts indicate support for Nifty at 5200 and lower levels. Resistance is currently developing at 5600 levels, but the numbers from the Bears are too small to conclude anything right now.

Friday was a nothing day from the Option Writers, except for addition of 11 lacs+ OI at 5100 PE and 5200 PE by the Bulls. At the beginning of the April series, the Option charts indicate support for Nifty at 5200 and lower levels. Resistance is currently developing at 5600 levels, but the numbers from the Bears are too small to conclude anything right now.For Monday, immediate resistance for Nifty Spot comes at 5325/5330 level. Staying above this, the intraday trend will be positive, and Nifty will head for its next resistance levels of 5355-5385 and 5410 levels. Above 5400/5410 levels, the breakout above the falling trendline can take Nifty to new highs in the short term. On the downside, support for Nifty Spot comes at 5290/5285 levels. Below this, next support comes at 5270/5265 levels. Sustained move below both these levels will turn the short term momentum to down, which can leads to Nifty closing the gap formed on 30th March.

9 April - Nifty Spot resistance at 5330-5355-5385-5410. Support at 5285-5270-5245-5220 - www.niftypower.com

Visit here for Nifty Tips - Nifty Future Tips and Nifty Option Tips

No comments:

Post a Comment