On Monday, Nifty will open for the last trading day of what have been an extremely rangebound month of trading.The monthly closing will be keenly watched by all traders. The Bulls will be hoping for a close above 5250/5270 Spot, as a signal for the end of this correction. on the other hand, the Bears will try to for a close below 5200, to continue the downmove and hope for a momentum move on the downside.Traders who are holding positional shorts, can now keep a stop and reverse at 5280 for their shorts.

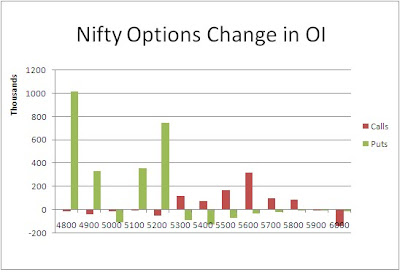

The Nifty option OI Charts are given below:

On Friday, the Bulls added 18 lacs+ OI from 4900 PE to 5100 PE strike. On the other hand, the Bears were active from 5200 CE to 5400 CE strike, adding 14 lacs+ OI. Overall, at the start of the new series, 5200 and 5300 are the two levels to watch for Nifty. Important to note that the support has shifted from 5200 to 5100 from the last series. This can be considered a small victory for the Bears, for the time being. Overall, 5100 and 5000 are the two major supports as per the Option Charts, and 5400 and 5600 are the major resistances.

For tomorrow, immediate resistance for Nifty Spot comes at 5220-5230 zone. Above this, the Bulls will try and take it towards higher level of 5260-5290 levels. A close above 5290 can signal a short term trend change for Nifty, to be confirmed by a close above 5330. On the downside, support for Nifty Spot comes at 5175-5180 level. Below this, the next major support for Nifty Spot comes at 5155-5160 level. Only below 5155, can the Bears hope for some downward momentum, which has been eluding them till now.

30 Apr - Nifty Spot resistance at 5230-5260-5290-5325. Support at 5175-5155-5120-5070 - www.niftypower.com

Visit here for Nifty Tips - Nifty Future Tips and Nifty Option Tips