Monday, December 31, 2012

31 Dec - Nifty View

On Friday, Nifty formed and Inside Day on Daily charts, by trading within the range of Thursday, and closing near 5908 level. Monday is the monthly close, as well as the yearly close for Nifty. Whether it breaks out of the 100 point one, within which it has been trading for entire December, remains to be seen. Till that happens, Nifty View for traders remains the same. Positional traders can either wait for a breakout, or trade the zone of 5840 to 5940, buying near the low and selling near the high, with a 20 point Stoploss and Reverse trade.

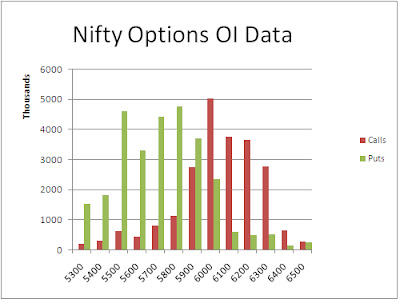

The Nifty Option OI Charts are given below:

In Nifty Options, it was the first day of the series, and as is expected, there was good amount of open interest addition by the Bulls. The Bulls added a huge quantity of 35 lacs+ open interest in Nifty option strikes of 5600 PE to 5900 PE. On the other hand, the Bears were a little subdues, and added only around 16 lacs+ open interest at Nifty Option strikes of 6100 CE and 6200 CE.Overall, at the start of the series, the Nifty Option charts look very similar to the December series, with 5900 as the 50:50 level, and 5800 and 6000 as support and resistance levels.

For Monday, immediate resistance for Nifty Spot comes at 5905/5910 level. Staying above this, the Bulls will try for higher level resistances of 5930 and 5945. Above 5945, it will be breakout and we can witness a short covering rally till 5990 and 6020 levels. On the downside, support for Nifty Spot comes at 5890 level. Below this, the Bears will continue to have an upper hand, and they will push Nifty down towards 5870/5850 and 5835 levels.

31 Dec - Nifty Spot resistance at 5905-5930-5945-5990. Support at 5890-5870-5850-5835 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Thursday, December 27, 2012

28 Dec - Nifty View

On Thursday, Nifty opened, but continued to decline for entire day, and finished the December series at 5870 Spot level. Entire month of December was largely spent within the 100 point range of 5840 to 5940. Now with the start of a new series, traders can hope for a breakout/ breakdown. When that will happen is anybody's guess. Till it happens, positional traders can wait on the sidelines, or do intraday trades with tight stoplosses and small targets. Trading will be easy beyond this range. There is no pint in trying to predict and trade micro moves within this small range.

The Nifty Option OI Charts are given below:

On the Options front, there was good addition by both the Bulls and the Bears, as would be expected at the start of a new series. The Bulls were mainly active in Nifty Options of 5500 PE to 6000 PE. The Bears were mainly active in Nifty Options of 5900 CE to 6300 CE. Maximum addition in open interest was at nifty option of 6000 CE by the Bears, where they added 11 lacs+ open interest. Overall, 6000 is once again standing tall as the major resistance for this series also. 5800 and below are the supports, while 5900 is the 50:50 level. The open interest at various strikes are very low to make any conclusion from the Nifty Option Charts. These charts will be more relevant after the next 3-4 trading days.

For Friday, immediate resistance for Nifty Spot will now come at 5870/5890 levels. If the Bulls manage to sustain Nifty above these levels, then it will again head for strong resistance areas of 5905/5930 and 5945 levels. Above 5945, it will be a major breakout for Nifty. On the downside, support for Nifty Spot comes at 5850 levels. Staying below this, Nifty Spot will head for lower level supports of 5835 and 5815 levels. Below 5815, 5790/5770 and 5745 will be targets.

28 Dec - Nifty Spot resistance at 5870-5890-5905-5930. Support at 5850-5835-5815-5790 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Monday, December 24, 2012

Saturday, December 22, 2012

Nifty Performance Update

After three weeks of rangbound trading in December, here is a look at how our various services performed:

Click Here to see the Nifty Performance Spreadsheet:

| NiftyPower’s Performance Summary – December 2012 | |||

| Max. Profits in Points/Lot | Safe Traders Strategy | Risky Traders Strategy | |

| Nifty Live Charts | 228 | 265 | 266 |

| Rs. 11400 | Rs. 13250 | Rs. 13300 | |

| 45.6% | 26.5% | 17.7% | |

| Nifty Futures SureShot | 112 | 118 | 158 |

| Rs. 5600 | Rs. 5900 | Rs. 7900 | |

| 22.4% | 11.8% | 10.5% | |

| Nifty Future Single Target | 56 | 112 | 168 |

| Rs. 2800 | Rs. 5600 | Rs. 8400 | |

| 11.2% | 11.2% | 11.2% | |

| Nifty Options SureShot | 30 | -12 | 52 |

| Rs. 1500 | -Rs. 600 | Rs. 2600 | |

| 30.0% | -3.0% | 6.5% | |

| Nifty Options Single Target | -6 | -24 | -48 |

| -Rs. 300 | -Rs. 1200 | -Rs. 2400 | |

| -6.0% | -6.0% | -6.0% | |

| Nifty Future Positional | 28 | 51 | 102 |

| Rs. 1400 | Rs. 2550 | Rs. 5100 | |

| 5.6% | 5.1% | 5.1% | |

Till now, Our Live Charts has given an excellent returns of over 25% this month. In such a rangebound month, where Nifty has been trading within a band of 100 points for the entire month, this is a very good return. This just goes to show that once you have a good system, Discipline is all that is required to make money.

In our SMS packages, our Performance has not been upto the mark for the second month in a row. We have done well to have minor profits in our Nifty Future Packages. However, our Option Packages are breakeven or slightly negative till now. The only silver lining is that inspite of having 2 bad months in a row, we have Not lost money. By taking small losses and making bigger profits, we have at least been able to Save our Capital during these difficult times. Once we are able to do that, Profits will come automatically. After all, this is what trading is all about – Small Losses and Bigger Profits. Our Positional Package has also been more or less breakeven after three months of bumper profits. Once Nifty breaks out of the 100 point range of 5840 to 5940, we expect much better performance from this package.

Happy Trading!

NiftyPower Team

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Thursday, December 20, 2012

20 Dec - Nifty View

On Wednesday, Nifty opened up, but then traded within a narrow band, to close near its resistance level of 5930. For all the 13 trading days of this series, Nifty Spot has traded within the zone of 5835 to 5945. Now it is once again at the top of this zone. There are two ways to approach the market right now. Traders can either trade the range until one trade Stops out, at which point they can Reverse their trades. Such traders can initiate a Short trade here with a Stop and Reverse to Long trade above 5945 Spot. The other approach is to wait for a breakout/ breakdown out of the range, and then keep a Stoploss below the Breakout level on closing basis. For example, at this point, such traders should wait for a breakout, and if it happens, initiate a Long trade with Stoploss below 5945 on Closing basis. At NiftyPower, we prefer to do the second option, and manage only intraday trades till we get a breakout.

The Nifty Option OI Charts are given below:

On the Nifty Option front, the Bulls added a small amount of 4 lacs+ Open Interest at 6000 PE strike, whereas the Bears added 6 lacs+ Open Interest at Nifty Option of 6100 CE.The Bears also covered a large amount of Open Interest at Nifty Option of 5800 CE. Overall, the range for this series remains the same. 5900 is the 50:50 level, while 5800 to 6000 is the narrow range.

For Thursday, immediate resistance for Nifty Spot comes at 5930 and 5945/5950 levels.Staying above this, a threat of Bullish breakout will be there, which can cause the Bears to panic, and lead to a short covering rally till 5985/5990 and 6020 levels. On the downside, support for Nifty Spot comes around 5905/5910 levels. Below this, the rangebound trading is expected to continue, with lower supports for Nifty coming at 5890, 5870 and 5835 levels.

20 Dec - Nifty Spot resistance at 5930-5950-5990-6020. Support at 5905-5890-5870-5850 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Sunday, December 16, 2012

17 Dec - Nifty View

On Friday, Nifty opened near its support of 5840 level, and recovered in intraday trade to close near 5880 level. For the past tow weeks, Nifty has traded within 100 point range of 5840 to 5940 Spot. This is also the high and low of the Hanging Man pattern which was given in the Nifty View of 5th December. Any substantial move will be expected if and when Nifty closes outside of this range. Till then, Positional traders can either wait and watch, or maintain Short Positions with Stoploss above 5945 on closing basis.

The Nifty Option OI Charts are given below:

The Nifty Option Charts were dominated by the Bulls on Friday, who added 14 lacs+ open interest at 5800 PE and 5900 PE strikes. The Bears did not do much on Friday. Overall, the Open Interest at 6000 CE remains at extremely high levels of 1.1 Crore+. This remains as the major resistance for this series. Nifty will find it very hard to cross this resistance level, and if it does so, it should give a substantial rally. A little below 6000 will become the Stoploss for a Long trade at that time. On the downside, 5800 is a major support level, with Open Interest at 5800 PE strike at 91 lacs+ at this time. 5900 remains as the 50:50 level for this series.

For Monday, the Bulls are expected to maintain an upper hand, till Nifty stays above the close of Friday. Immediate resistance for Nifty Spot comes at 5890/5905 levels. Above this, 5930 and 5950 are the next major resistance levels. On the downside, immediate support for Nifty Spot comes at 5870/5850 and 5835 levels. As given earlier, till the time Nifty is trading within the range of 5835 to 5950, it is better to trade intraday with tight stoplosses and quickly booking profits for small gains. Beyond this range, a substantial move is expected in Nifty.

17 Dec - Nifty Spot resistance at 5890-5905-5930-5950. Support at 5870-5850-5835-5815 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Thursday, December 13, 2012

14 Dec - Nifty View

On Thursday, Nifty finally broke down, one week after the Hanging Man pattern was formed on Daily Charts and pointed here in Nifty View. It still managed to hold on to the Low of Hanging man, which will give some hope to the Bulls. This cooling off/ correction was much needed, and now, it remains to be seen whether Nifty consolidates here, to build a base for another upside move, or whether a deeper correction sets in. The first sign of a deeper correction will come if and when Nifty breaks below 5815/5790 and 5770 levels. Till then, the market remains Sell on Rises for intraday traders, while Positional traders can hold their Short Positions with Stoploss around 5915 Nifty Spot on closing basis.

The Nifty Option OI Charts are given below:

On the Nifty Options front, not much Open Interest activity was seen by both the Bulls and the Bears. The Bears added 14 lacs+ Open Interest in Nifty Options of 5900 CE to 6100 CE Strike. The Bulls were absent today and did very little addition. Overall, the Open Interest at 6000 CE strike has moved to a Huge Level of 1.15 Crore+. Although a Bearish sign, this also gives a signal that if the Bulls somehow to manage to capture this level, we can see a huge Short Covering rally from the Bears. Going forward, some profit booking is expected at 6000 CE Strike. Apart from that, 5900 remains as the 50:50 level, while 5800 is the immediate support level for Nifty, with Open Interest at 5800 PE at 80 lacs+.

For Friday immediate resistance for Nifty Spot comes at 5870 and 5890/5905 levels. On any upside, Selling Pressure is expected at each of these levels, and can be used by traders to build Short Positions. Above 5905, the Bulls are expected to dominate, and Shorts should not be tried by intraday traders. On the downside, support for Nifty Spot comes at 5850/5840 levels. Staying below this, the Bearish momentum will continue, and Nifty can slide lower towards 5825/5815 levels, where it has found support earlier. Below these levels, 5790/5770 are the levels to watch out for. Any breach of these levels will be the first sign of a deeper correction setting in in Nifty.

14 Dec - Nifty Spot resistance at 5870-5890-5905-5930. Support at 5840-5820-5790-5770 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Monday, December 10, 2012

10 Dec - Nifty View

On Friday, Nifty followed up to the Hanging Man pattern pointed out in our Nifty View, and formed a Bearish candle on Daily charts, by closing near 5907 levels. The Stoploss for those who had taken aggressive Positional Shorts, on Thursday, was given as 5950 in our previous Nifty View. Nifty made a High at 5949 on Friday, hence, the Shorts are still in trade. Traders who are Short, can now keep a Stoploss at either 5950 Spot, or at 5945 Spot on closing basis, which is the High of Thursday's Hanging Man pattern. As long as Nifty is trading within the range of 5880 to 5950, it will better to trade on Intraday basis. Below 5880, the Bears are expected to dominate, while above 5950, the Bulls will dominate, leading Nifty Spot to 5990 and 6020 levels.

The Nifty Option OI Charts are given below:

On the Options front, the Bears added big quantities of 7 lacs+ and 15 lacs_ Open Interest at 6000 CE and 6100 CE strikes respectively. These two levels are major resistances for Nifty as of now. The Bulls did not do much on Friday. Overall, 5900 is the clear 50:50 level on Option Charts. Below that, 5800 and lower levels can be termed as minor support levels as of now. On the upside, 6000 is the major resistance for this series, with Open Interest at 6000 CE well above 80 lacs mark right now.

For Monday, immediate resistance for Nifty Spot comes at 5910/5930 zone. Staying above this, Nifty can again head for resistance levels around 5950 mark. Till it stays below these levels, it is expected to meet with selling pressure at each of these levels. However, above these rallies, the Bears will run for cover, and Nifty can easily climb towards 5990 and 6020 levels. On the downside, support for Nifty Spot comes at 5890/5870 zone. Below this, Nifty is expected to break the immediate support of 5850, and head towards 5825/5815 levels.

10 Dec - Nifty Spot resistance at 5910-5930-5950-5990. Support at 5890-5870-5850-5820 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

The Nifty Option OI Charts are given below:

On the Options front, the Bears added big quantities of 7 lacs+ and 15 lacs_ Open Interest at 6000 CE and 6100 CE strikes respectively. These two levels are major resistances for Nifty as of now. The Bulls did not do much on Friday. Overall, 5900 is the clear 50:50 level on Option Charts. Below that, 5800 and lower levels can be termed as minor support levels as of now. On the upside, 6000 is the major resistance for this series, with Open Interest at 6000 CE well above 80 lacs mark right now.

For Monday, immediate resistance for Nifty Spot comes at 5910/5930 zone. Staying above this, Nifty can again head for resistance levels around 5950 mark. Till it stays below these levels, it is expected to meet with selling pressure at each of these levels. However, above these rallies, the Bears will run for cover, and Nifty can easily climb towards 5990 and 6020 levels. On the downside, support for Nifty Spot comes at 5890/5870 zone. Below this, Nifty is expected to break the immediate support of 5850, and head towards 5825/5815 levels.

10 Dec - Nifty Spot resistance at 5910-5930-5950-5990. Support at 5890-5870-5850-5820 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Friday, December 7, 2012

7 Dec - Nifty View

On Thursday, Nifty opened up, moved down swiftly to make an intraday low of 5838,, and then made a remarkable recovery, to close near 5930 level. It broke our reference level of 5880/5870 in intraday and went nearly 40 points down, but closed well above it. Positional traders, who would have taken aggressive Shorts, below 5880/5870, and have not exited them, can now keep a Stoploss around 5950 Spot level. In Yesterday's Nifty View, it was given that how Bulls react at the support levels below 5880, will give more clarity on the inherent strength of the market. The Bulls have clearly shown the strength of this rally. The only solace for the Bears at this moment is the huge built up in Open Interest at 6000 CE strike, and a Hanging Man pattern on Daily Charts. This pattern needs a follow-up move tomorrow, to be of any relevance. Hence, we will not consider it as of now, and consider it only if Nifty Spot starts trading below 5900/5880 again. Till then, the uptrend continues, and Shorts should keep a strict Stoploss.

The Nifty Option OI Charts are given below:

On the Options front, there was not much activity today by both the Bulls and the Bears. The Bulls added a small amount of Open Interest at 6000 PE strike, while the Bears added a small amount at 6300 CE strike. Overall, the Option Charts remain the same, with 5900 being the 50:50 level for this series as of now. 6000 is the toughest resistance. Supports lie at the 5800 and below levels, however, the Open Interest at these strikes is not enough to call them as major supports as of now.

For Friday, immediate resistance for Nifty Spot will come at 5930/5950 levels. Stayinga bove this, the next big resistance for Nifty Spot will come around 5985/5995 levels. If the Bulls manage to sustain Nifty above these levels, then we can see another fierce short covering rally, when the 6000 CE writers start covering their positions. On the downside, support for Nifty Spot comes at 5910/5885 levels. Till Nifty trades above these levels, momentum will favor the Bulls, However, another break below these levels tomorrow can lead to a bigger fall this time.

7 Dec - Nifty Spot resistance at 5930-5950-5990-6020. Support at 5905-5890-5870-5850 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

The Nifty Option OI Charts are given below:

On the Options front, there was not much activity today by both the Bulls and the Bears. The Bulls added a small amount of Open Interest at 6000 PE strike, while the Bears added a small amount at 6300 CE strike. Overall, the Option Charts remain the same, with 5900 being the 50:50 level for this series as of now. 6000 is the toughest resistance. Supports lie at the 5800 and below levels, however, the Open Interest at these strikes is not enough to call them as major supports as of now.

For Friday, immediate resistance for Nifty Spot will come at 5930/5950 levels. Stayinga bove this, the next big resistance for Nifty Spot will come around 5985/5995 levels. If the Bulls manage to sustain Nifty above these levels, then we can see another fierce short covering rally, when the 6000 CE writers start covering their positions. On the downside, support for Nifty Spot comes at 5910/5885 levels. Till Nifty trades above these levels, momentum will favor the Bulls, However, another break below these levels tomorrow can lead to a bigger fall this time.

7 Dec - Nifty Spot resistance at 5930-5950-5990-6020. Support at 5905-5890-5870-5850 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Wednesday, December 5, 2012

6 Dec - Nifty View

On Wednesday, Nifty once again traded in a narrow band, and closed near 5900 level, to form another Doji on Daily Charts. Some cooling off was expected this week, after he run-up in Nifty last week. However, Nifty has held on to its gain so far this week, ahead of the FDI Voting News. The lower volumes that we have seen over the past few days indicates that the traders have been waiting for the News to get out of the way, before building any positions. Now, after the event is over, it remains to be seen whether Nifty continues its upmove, or whether it becomes a "Sell the News" kind of trade, and Nifty will correct from here, to test its Support levels. Immediate levels to watch out on the downside will be 5880/5870 zone. Till Nifty is staying above this level, even aggressive traders should not be thinking of any Short trade. However, if Nifty breaks this zone, then a slide towards 5825/5815 and 5790/5770 is possible. How the Bulls support these levels, will give further clarity on the inherent strength of the market. As of now, Aggressive traders should wait for a Short Opportunity below 5880/5870. Till then, it remains a Buy on Dips.

The Nifty Option OI Charts are given below:

On the Options front also, the volumes have been on the lower side. The Bears were mainly active at 6200 CE strike, where they added 8 lacs+ Open Interest. On the other hand, the Bulls added small quantities of Open Interest at 6000 PE and below strikes. Overall, 6000 remains the biggest resistance this series, with Open Interest crossing 80lacs+ at 6000 CE strike. 5900 is the 50:50 level as of now. For supports, the Bulls also seem to be waiting for a downmove to add Open Interest. As of now, 5800 and below can be called as Minor Support levels. But this picture is sure to change, when Nifty decline towards those levels, and the Bulls start adding Open Interest

For Thursday, immediate resistance for Nifty Spot comes at 5900/5905 level. Staying above this, the Bulls are expected to remain in control, and take it to higher level resistances of 5930/5950 and 5985 level. On the downside, support for Nifty Spot comes at 5890 and 5870 levels. As long as it stays above these levels, the Bulls will have a chance to bounce back. Below 5870, the Bears will start to dominate, and they can take Nifty lower to test supports of 5850 and 5825/5815.

6 Dec - Nifty Spot resistance at 5905-5930-5950-5985. Support at 5890-5870-5850-5820 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

The Nifty Option OI Charts are given below:

On the Options front also, the volumes have been on the lower side. The Bears were mainly active at 6200 CE strike, where they added 8 lacs+ Open Interest. On the other hand, the Bulls added small quantities of Open Interest at 6000 PE and below strikes. Overall, 6000 remains the biggest resistance this series, with Open Interest crossing 80lacs+ at 6000 CE strike. 5900 is the 50:50 level as of now. For supports, the Bulls also seem to be waiting for a downmove to add Open Interest. As of now, 5800 and below can be called as Minor Support levels. But this picture is sure to change, when Nifty decline towards those levels, and the Bulls start adding Open Interest

For Thursday, immediate resistance for Nifty Spot comes at 5900/5905 level. Staying above this, the Bulls are expected to remain in control, and take it to higher level resistances of 5930/5950 and 5985 level. On the downside, support for Nifty Spot comes at 5890 and 5870 levels. As long as it stays above these levels, the Bulls will have a chance to bounce back. Below 5870, the Bears will start to dominate, and they can take Nifty lower to test supports of 5850 and 5825/5815.

6 Dec - Nifty Spot resistance at 5905-5930-5950-5985. Support at 5890-5870-5850-5820 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Sunday, December 2, 2012

3 Dec - Nifty View

On Friday, Nifty opened Gap Up, came down to fill the Gap in intraday, and then climbed up again to close near 5880 level. In the past 3 trading days, Nifty has rallied 200+ points. Positional Traders who are in Long Positions, can move their Stoploss to around 5730 Spot level. Some cooling off from the highs can be expected next week, but the short term should be considered Up as long as Nifty is trading above 5700/5730 zone. The immediate support for Nifty Spot should come at the recent breakout level of 5815 and 5790/5770 levels. Any downmove towards these levels can be used to build Long Positions in Nifty. The breakout level of 5650/5630 and below that, the Gap Support level of 5520 are now the Support Levels for considering the Medium Term Trend.

The Nifty Option OI Charts are given below:

On the Options front, the first day of the series was used to build positions by both the Bulls and the Bears. The most significant addition by the Bulls was at 5800 PE and 5900 PE strikes, where they added 22 lacs+ OI. The most significant addition by the Bears was at 6100 CE strike, where they added 9 lacs+ OI. Overall, 6000 seems like the toughest resistance as of now, with highest open interest of 60 lacs+ at 6000 CE after the first day of the series. 5700 and below are the supports.

For Monday, immediate resistance for Nifty Spot now comes at 5880/5885 level. Above this, the Bulls will again be in control, and take Nifty higher towards 5930, 5950 and 5980/5990 levels. On the downside, support for Nifty Spot comes at 5850/5860 level. Staying below this, the Bears can pull it down towards lower level supports of 5815, 5790 and 5770. On Intraday basis, traders can use declines towards 5815 Spot level to Buy Nifty. Below 5815, the Bears will dominate.

3 Dec - Nifty Spot resistance at 5885-5930-5950-5985. Support at 5855-5830-5815-5790 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

The Nifty Option OI Charts are given below:

On the Options front, the first day of the series was used to build positions by both the Bulls and the Bears. The most significant addition by the Bulls was at 5800 PE and 5900 PE strikes, where they added 22 lacs+ OI. The most significant addition by the Bears was at 6100 CE strike, where they added 9 lacs+ OI. Overall, 6000 seems like the toughest resistance as of now, with highest open interest of 60 lacs+ at 6000 CE after the first day of the series. 5700 and below are the supports.

For Monday, immediate resistance for Nifty Spot now comes at 5880/5885 level. Above this, the Bulls will again be in control, and take Nifty higher towards 5930, 5950 and 5980/5990 levels. On the downside, support for Nifty Spot comes at 5850/5860 level. Staying below this, the Bears can pull it down towards lower level supports of 5815, 5790 and 5770. On Intraday basis, traders can use declines towards 5815 Spot level to Buy Nifty. Below 5815, the Bears will dominate.

3 Dec - Nifty Spot resistance at 5885-5930-5950-5985. Support at 5855-5830-5815-5790 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Wednesday, November 28, 2012

29 Nov - Nifty View

On Tuesday, Nifty opened up above its resistance of 5655, and then made a smart rally to close near its upper resistance of 5730. As given in earlier Nifty View, Positional Traders are already in Long Positions from near 5615 levels. Some profit should be booked in these longs and Stoploss can now be modified and kept near 5650 Spot level. On the upside, there are minor resistance levels at 5755 and 5785 levels, above which, the recent high near 5815 will be the immediate resistance. On the downside, the levels of 5690 and 5650/5630 will provide support, and short term trend should be considered up as long as Nifty is closing above these levels.

The Nifty Option OI Charts are given below:

On the Options front, the Bears ran for cover on Tuesday. They covered a huge amount of 58 lacs+ OI at 5600 CE and 5700 CE strikes. This move is understandable, given that Expiry is only 1 day away, as Wednesday was a holiday. But the move from the Bulls was definitely a risky one, who added 31 lacs+ OI at 5700 PE strike. After Tuesday's move, 5700 has become the 50:50 level for Nifty. 5800 remains the major resistance for the series, while 5600 is the major support.

For Thursday, the trend for Nifty should be considered positive as long as Nifty Spot stays above 5690/5695 Spot level. Intraday traders can adopt a Buy on Dips strategy till these levels are protected. On the upside, resistance for Nifty Spot comes at 5730. Staying above this, the Bulls will take it to higher level resistances of 5755 and 5785 levels. On the downside, support for Nifty Spot comes at 5690 level. Below this, it can slide lower towards support levels of 5655/5650 and 5630 levels. The Short term trend should be considered up as long as Nifty Spot stays above 5630 level.

29 Nov - Nifty Spot resistance at 5730-5755-5785-5815. Support at 5705-5690-5655-5630 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

The Nifty Option OI Charts are given below:

On the Options front, the Bears ran for cover on Tuesday. They covered a huge amount of 58 lacs+ OI at 5600 CE and 5700 CE strikes. This move is understandable, given that Expiry is only 1 day away, as Wednesday was a holiday. But the move from the Bulls was definitely a risky one, who added 31 lacs+ OI at 5700 PE strike. After Tuesday's move, 5700 has become the 50:50 level for Nifty. 5800 remains the major resistance for the series, while 5600 is the major support.

For Thursday, the trend for Nifty should be considered positive as long as Nifty Spot stays above 5690/5695 Spot level. Intraday traders can adopt a Buy on Dips strategy till these levels are protected. On the upside, resistance for Nifty Spot comes at 5730. Staying above this, the Bulls will take it to higher level resistances of 5755 and 5785 levels. On the downside, support for Nifty Spot comes at 5690 level. Below this, it can slide lower towards support levels of 5655/5650 and 5630 levels. The Short term trend should be considered up as long as Nifty Spot stays above 5630 level.

29 Nov - Nifty Spot resistance at 5730-5755-5785-5815. Support at 5705-5690-5655-5630 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Sunday, November 25, 2012

26 Nov - Nifty View

On Friday, Nifty opened flat, declined in intraday trade and tested its support level of 5590 Spot, and then recovered to close near its resistance level of 5625/5630. As given in previous Nifty View, Positional traders should have opened small long Positions with a Stop and Reverse at 5570 Spot level. This Stoploss can be raised near 5590 level now, which was Friday's low. On the upside, 5630/5655 remains the resistances to watch, and until Nifty is able to cross and sustain above this zone, this upmove will be suspect. Hence, it is better to keep a tight Stoploss in Long positions.

The Nifty Option OI Charts are given below:

On the Options front, the Bulls were seen covering their positions on Friday. They covered 16 lacs+ OI at 5500 PE and 5600 PE strikes. Also, there was no addition by the Bulls at any of the strikes. On the other hand, the Bears also did not do much, except for a small addition of 6 lacs+ OI at 5700 CE strike.Overall, 5600 is a minor support, while 5500 is a major support for this series. On the upside, 5700 and 5800 are the biggest resistances, with Open Interest at strikes of 5700 CE and 5800 CE at 80 lacs+ level.

For Monday, immediate resistance for Nifty Spot comes at 5630 level. Above this, the Bulls will easily take Nifty to its next resistance level at 5650/5655 level. Above 5655, we can see some Short Covering rally till 5685/5705 Nifty Spot level. On the downside, support for Nifty Spot comes at 5590 level. Below this, the Bears will have an upper hand, and they will push Nifty down towards 5570 and 5550 level.

26 Nov - Nifty Spot resistance at 5630-5655-5685-5705. Support at 5605-5590-5570-5550 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

The Nifty Option OI Charts are given below:

On the Options front, the Bulls were seen covering their positions on Friday. They covered 16 lacs+ OI at 5500 PE and 5600 PE strikes. Also, there was no addition by the Bulls at any of the strikes. On the other hand, the Bears also did not do much, except for a small addition of 6 lacs+ OI at 5700 CE strike.Overall, 5600 is a minor support, while 5500 is a major support for this series. On the upside, 5700 and 5800 are the biggest resistances, with Open Interest at strikes of 5700 CE and 5800 CE at 80 lacs+ level.

For Monday, immediate resistance for Nifty Spot comes at 5630 level. Above this, the Bulls will easily take Nifty to its next resistance level at 5650/5655 level. Above 5655, we can see some Short Covering rally till 5685/5705 Nifty Spot level. On the downside, support for Nifty Spot comes at 5590 level. Below this, the Bears will have an upper hand, and they will push Nifty down towards 5570 and 5550 level.

26 Nov - Nifty Spot resistance at 5630-5655-5685-5705. Support at 5605-5590-5570-5550 - www.niftypower.com

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Saturday, November 24, 2012

Nifty Performance Update (till 23rd Nov, 2012)

Going into the last week of November, here is a Performance Update of our various packages:

Click here to see the Performance Spreadsheet

| NiftyPower’s Performance Summary – November 2012 | |||

| Max. Profits in Points/Lot | Safe Traders Strategy | Risky Traders Strategy | |

| Nifty Live Charts | 67 | 17 | 7 |

| Rs. 3350 | Rs. 850 | Rs. 350 | |

| 13.4% | 1.7% | 0.5% | |

| Nifty Futures SureShot | 102 | 91 | 125 |

| Rs. 5100 | Rs. 4550 | Rs. 6250 | |

| 20.4% | 9.1% | 8.3% | |

| Nifty Future Single Target | 29 | 58 | 87 |

| Rs. 1450 | Rs. 2900 | Rs. 4350 | |

| 5.8% | 5.8% | 5.8% | |

| Nifty Options SureShot | 64 | 102 | 218 |

| Rs. 3200 | Rs. 5100 | Rs. 10900 | |

| 64.0% | 25.5% | 27.3% | |

| Nifty Options Single Target | 31 | 124 | 248 |

| Rs. 1550 | Rs. 6200 | Rs. 12400 | |

| 31.0% | 31.0% | 31.0% | |

| Nifty Future Positional | 98 | 131 | 262 |

| Rs. 4900 | Rs. 6550 | Rs. 13100 | |

| 19.6% | 13.1% | 13.1% | |

November was a month of Contrasts for our Live Nifty Charts and SMS Packages. While the Live Nifty Charts started on a very strong note, we did not match up to the same performance in the first week, and infact, were even negative at one point of time. However, during the last to weeks, we not only covered all losses made in the first week, but also broke into a healthy profit. In fact, in our SMS packages, we have had only 1 loss making call in the last two weeks. On the other hand, our Live Nifty Charts gave some false signals in the last two weeks, which resulted in losing of most of the profits that was generated in the first week. The Silver Lining is that it is still in Green.

The Best package this month has been Nifty Options, which has given a return of nearly 30% till now. The worst performing package is Live Nifty Charts, which is just about breakeven with a 1% return. In the coming days, we will continue to focus on the SMS Packages, and try and maxmize the returns this month. Also, we will have an eye on the Live Nifty Charts, as we definitely do not want any of our package to end the month in Red.

Happy Trading!

NiftyPower Team

P.S.:

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

You can see Live Nifty Charts with Buy Sell Signals during market hours Free on our website www.niftycharts.co.in

Also, Read our Daily Nifty Analysis published on our Blog www.nifty-power.blogspot.in and have an Edge in you trading

For our regular Paid SMS Services, see Rates and Services Page on www.niftypower.com

Subscribe to:

Comments (Atom)