Friday turned out to be a Black Friday for a lot of Indian traders. For the past week, the major movement in Nifty had been due to Gap Ups and Gap Downs only. The remaining movement during intraday remained rangebound only. This was the first warning signs that Positional trading was a No-No at this point of time. However, we would like to remind the readers of the suggestion for a Option Straddle given in the post of Aug 1 (click here to read). The straddle of 5500 CE and 5500 PE was trading at a net cost of around Rs. 200 at that time. Today the cost is Rs. 330+ and it made a high of nearly 380+. Almost doubling the money without any Risk to the Capital employed. It was a common sense trade and not based on any complex Technical Analysis.

As of now, Nifty has broken the previous low of 5195, formed on 20th June. Upside, there remains a big 100 point gap to be filled from 5230 to 5330. As marked in the chart, the oscillators have reached oversold levels, although they do not matter much in trending moves like these. Overall, it looks like we may get a dead cat bounce now to fill this gap of 5230 to 5330. When this bounce will come is anybody's guess. For now, positional traders can wait for the oscillators to correct upwards before taking Fresh Short positions in Nifty. This is assuming that we do not breakout above 5330 in case of any bounce.

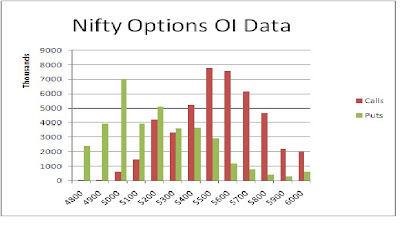

The Options OI Charts is given below:

The August series had started with a range of 5400 to 5700. This range has shifted down considerably now. The Bulls are now building support at 5000 levels now, with nearly 70 lacs OI at 5000 PE strike. On the other hand, the Bears have added big quantity of OI from 5100 CE to 5500 CE strikes. However, if we look at the Option OI charts, there is almost equal OI at 5200 to 5400 Calls and Puts. This can be due to the big Gap Down on Friday. The OI at these levels should get resolved next week, and then we will have a clear range coming out from the Option Charts.

For Monday, immediate resistance for Nifty Spot comes at 5225/5230 levels. Trading above these, it will target higher levels 5250 and 5295. Above 5295, the Gap resistance at 5325-5330 will come into picture. Since the trend is down and Nifty is expected to be volatile, be quick to book profit in Longs. On the downside, support for Nifty Spot comes at 5200-5195 levels. Below this, it will test 5170. The trend for the day turns down again below 5170, and we my even see a retest of the lows of Friday, below 5170.

8 Aug: Nifty Spot resistance at 5230-5255-5295-5325. Support at 5195-5170-5150-5115 - www.niftypower.com

Visit here for Nifty Option Tips

No comments:

Post a Comment