The Bulls came back on Monday, and How! We had a target of 4845 and 4890 on our minds above 4800. It rallied much more than that. Now, it needs to give a close above 4960 for the trend to become Neutral in the short term. Otherwise, the downtrend will resume. On the downside, the support area of 4845 and breakout point of 4815 should hold now for the uptrend to continue. otherwise, it will be time to enter shorts again for much lower targets. We will make our plans as the levels develop. As of now, play for the long side as long as Nifty holds 4900 on closing basis.

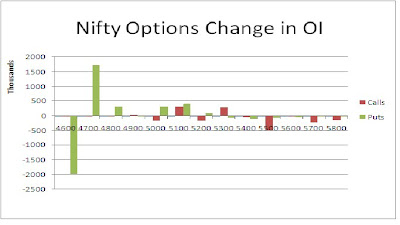

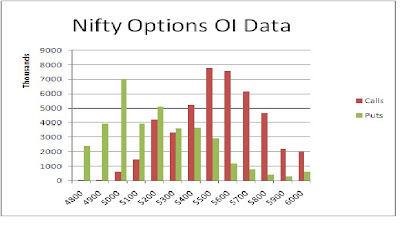

The Option OI charts are given below:

From yesterday's Option OI charts, 4800 was being indicated as a support, even though Nifty had slipped below it. Now we know why? For today, the movement in Options was on expected lines. The Bears covered OI of more than 11 lacs+ at 5000 CE and lower levels. The ulls on the the other hand added 27 lacs+ OI at 4600 PE to 5000 PE strikes. The Bears also added big amount of OI at 5100 CE and above strikes. Overall, 4800 and below are the supports that are indicated from the Options data. 5100 is the resistance. 4900 is the 50:50 level and 5000 is a minor resistance.

From yesterday's Option OI charts, 4800 was being indicated as a support, even though Nifty had slipped below it. Now we know why? For today, the movement in Options was on expected lines. The Bears covered OI of more than 11 lacs+ at 5000 CE and lower levels. The ulls on the the other hand added 27 lacs+ OI at 4600 PE to 5000 PE strikes. The Bears also added big amount of OI at 5100 CE and above strikes. Overall, 4800 and below are the supports that are indicated from the Options data. 5100 is the resistance. 4900 is the 50:50 level and 5000 is a minor resistance.

For tomorrow, immediate strong resistance for Nifty Spot comes at 4950/4960 range. If it manages to trade above these, it will target 5000 and higher levels of 5050-5070. On the downside, support for Nifty Spot comes at 4905 level. Intraday tarders can go short if it sustains below this level, for target of 4870 and 4850 levels. Below 4850, todays breakout point around 4815/4820 will come into the picture. As written earlier also, consider the trend to be positive and buy on dips tomorrow with stoploss placed at 4900 , below which, iIfty may slide to lower levels.

30 Aug: Nifty Spot resistance at 4955-4995-5020-5055. Support at 4905-4870-4850-4815 - www.niftypower.com

Visit here for Nifty Option Tips