In Yesterday's Nifty View, it was given to create Longs if Nifty slides towards 5420-5430 level. Thanks to the global cues, Nifty gave that golden opportunity to go long at the open. The low recorded was 5434! There is another lesson here for those who see the World markets and try to trade the Nifty. The correlation between different markets is a complex one, which cannot be gauged just by seeing whether it closed in the Red or Green. It is a wasteful exercise. Hence, better keep your analysis simple and follow your trade plan with strict money management. That is all that is needed for making money!

In Yesterday's Nifty View, it was given to create Longs if Nifty slides towards 5420-5430 level. Thanks to the global cues, Nifty gave that golden opportunity to go long at the open. The low recorded was 5434! There is another lesson here for those who see the World markets and try to trade the Nifty. The correlation between different markets is a complex one, which cannot be gauged just by seeing whether it closed in the Red or Green. It is a wasteful exercise. Hence, better keep your analysis simple and follow your trade plan with strict money management. That is all that is needed for making money!The Options OI Charts are given below:

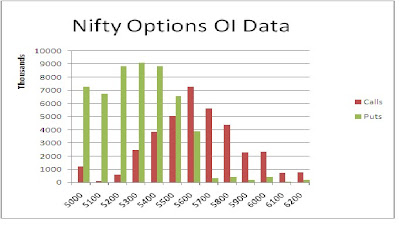

The Options Charts show the Bulls on rampage as of now. Since expiry is very near, we will not be giving much importance to the OI data now. It is sufficient to know that 5400 to 5600 is the range suggested by the Options table as of now. Also, now that the Bulls have taken charge, they should cause some more pain to the Bears till expiry. Any turnaround, if any, is expected to happen on or after expiry day only.

The Options Charts show the Bulls on rampage as of now. Since expiry is very near, we will not be giving much importance to the OI data now. It is sufficient to know that 5400 to 5600 is the range suggested by the Options table as of now. Also, now that the Bulls have taken charge, they should cause some more pain to the Bears till expiry. Any turnaround, if any, is expected to happen on or after expiry day only.For tomorrow, immediate resistance for Nifty Spot comes at 5545/50 area. Above this, expect it to remain positive and test higher levels of 5580-5610. Nifty is entering the earlier strong resistance zone of 5580-5610 now. Hence, be careful at higher levels. Prefer to go long near lower supports, rather than upper resistances now. On the downside, support for Nifty Spot comes at 5510/5505 level. If moves below this, it will go on to to test today's breakout level of 5480/5475 and 5435 below that.

28 June: Nifty Spot resistance at 5550-5580-5610-5630. Support at 5510-5475-5450-5435 - www.niftypower.com

Visit here for Nifty Options Tips

No comments:

Post a Comment