Nifty opened Gap Up today, made a high of 5558, and then slid down to make a low near 5496, before recovering again to close at 5542. After two days of dominance from the Bulls, today was an expected consolidation day. Volatility is on the rise after being on the lower side for the entire month of June. Higher volatility is always very good for intraday and short term traders.

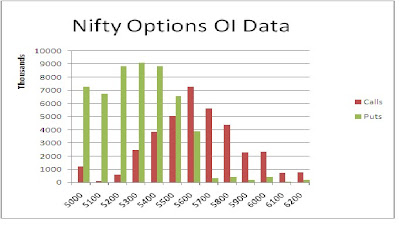

The Options Charts are given below:

Addition of OI does not matter much, so near to the expiry. If we look at next months OI charts, we find that the Bulls are getting aggressive right from the start of the series, building OI from 5500 PE and below strikes. The Bears are more subdued, having largest OI at 5600 CE strike, both for June and July series. This level is the level of the year, and it will take a herculean effort from the Bulls to break and close above it. From the Options Charts of June series, 5500 to 5600 seems to be the expiry range now.

For tomorrow, immediate resistance for Nifty Spot comes at 5545-5550 levels. If stays above it, Bulls will remain in control, and try to test higher level resistances of 5580 and 5610. Only above 5610, real Bull action will be seen. Till 5610 is not breached, anytime fast fall can happen. Hence, have strict stoplosses in all long positions. On the downside, support for Nifty Spot comes at 5515/5505 levels. Below this, it will slide towards the breakout zone of 5475/5480 and then 5445 and 5390 levels.

29 June: Nifty Spot resistance at 5550-5580-5610-5630. Support at 5510-5475-5445-5390 - www.niftypower.com

Visit here for Nifty Option Tips