The expiry is done. Nifty closed near 6100 levels this expiry. At this point, I would like to remind our readers of our Nifty View of 28 Dec. You can read it by clicking here. Nifty had closed near 5990 levels on 27 Dec. From the Options OI data, we sensed some unusual activity at strikes of 6100 CE. At that time also, we sensed that this could be the level where Nifty could try to close near expiry. Two days gone, and the unusual activity at 6100 CE has finally been explained!

The Options OI data for Jan shows big OI build up of over 50lac+ at 6000 PE levels. This would act as a support now at least in the beginning of this series. 6100 is the 50:50 levels for now and the battle would be fought around this level for now. As expected, 6200 has more OI at Calls than Puts. Some more days into the series would give more clarity on the emerging range.

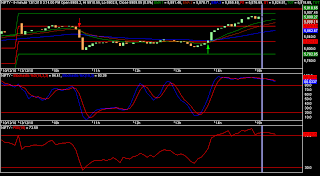

For tomorrow, watch the levels of 6110-6115 on Nifty spot. If Nifty manages to trade and stay above them in morning trades, it will try to test 6130-6150 levels on the upside. On the downside, support now exists at 6070/6065 Nifty spot. below this, we will again see slide upto 6035-6005 levels. Another important thing to note is that Nifty has closed above its 50 DMA after more than a month and then has given a follow-up move on the upside. Hence, consider the trend as Up and try to Buy on Dips for more upsides till we get signals of exhaustion from the market.

31 Dec: Nifty spot resistance at 6105-6115-6130-6150. Support 6070-6050-6035-6005 - www.niftypower.com

Visit here for Nifty Option Tips