On Wednesday, Nifty Spot Spot closed near 5430 level, after making an intraday high of 5435. With this, it achieved the second target of Positional Longs given in previous Nifty Views. Nifty is now very close to the recent high of 5448, that it made last month. Above that, it is a free area, where new short term resistances and supports will have to be formed. Nifty last traded above these levels in February and March of this year. A New High here, if made, would signify a significant upmove. For Positional Traders, the trend remains up as long as Nifty Spot trades above 5340/5330 levels. On the Upside, there are few levels to watch out for line 5490/5515 and 5590, but it is best to ride this upmove with a trailing stoploss, as if it pans out as expected, the upmove can provide good trending opportunities ahead.

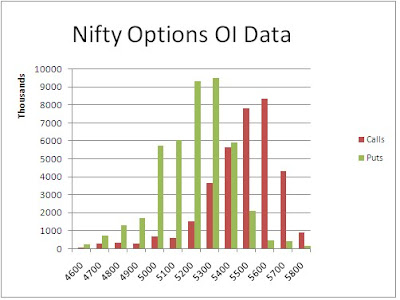

The Nifty Option OI Charts are given below:

On the Options front, the Bulls added a huge amount of 30 lacs+ OI from 5300 PE to 5500 PE strikes. The Bulls have taken over the Option charts, building solid supports at 5300 and 5200 levels. The Open interest in both 5200 PE and 5300 PE has now exceeded 90 lacs, and it is always a sign of strength to have suh high open interest. The level of 5400 has now become the 50:50 level, while 5500 and 5600 are the resistances.

On the Options front, the Bulls added a huge amount of 30 lacs+ OI from 5300 PE to 5500 PE strikes. The Bulls have taken over the Option charts, building solid supports at 5300 and 5200 levels. The Open interest in both 5200 PE and 5300 PE has now exceeded 90 lacs, and it is always a sign of strength to have suh high open interest. The level of 5400 has now become the 50:50 level, while 5500 and 5600 are the resistances.For tomorrow, immediate resistance for Nifty Spot now comes at 5430/5435 levels, and then around 5450 and 5490 levels. As given earlier, above 5450, Nifty will form a New high after March last year, and it can signify the start of a fresh upmove. On the downside, support for Nifty Spot comes at 5420/5415 levels. Any intraday dip to these levels can be used as an opportunity to go long. Below 5420, Nifty can slide to test 5400 and 5370/5360 levels. All these support areas are expected to bring Buyers, till the time Nifty is closing above 5340/5330 levels.

13 Sep - Nifty Spot resistance at 5435-5450-5490-5515. Support at 5415-5400-5365-5340 - www.niftypower.com

Visit here for Nifty Tips - Nifty Future Tips and Nifty Option Tips

No comments:

Post a Comment