Nifty opened down today, and traded in a volatile manner between 4750 to 4850, before finally closing up near 4840 levels. Today was a sort of shake out move, which would have made many weak Longs to exit their positions. The trend remains up as long as Nifty is trading above 4800/4770 levels. Upside resistances to watch out are at 4910/4960/4990 and 5015. Nifty can turn back from any of these levels, however, till it does not give a Short Signal, stay with the trend and trade as per the levels. No point in trying to predict the Tops and Bottoms.

Nifty opened down today, and traded in a volatile manner between 4750 to 4850, before finally closing up near 4840 levels. Today was a sort of shake out move, which would have made many weak Longs to exit their positions. The trend remains up as long as Nifty is trading above 4800/4770 levels. Upside resistances to watch out are at 4910/4960/4990 and 5015. Nifty can turn back from any of these levels, however, till it does not give a Short Signal, stay with the trend and trade as per the levels. No point in trying to predict the Tops and Bottoms.The Nifty Option Open Interest charts are given below:

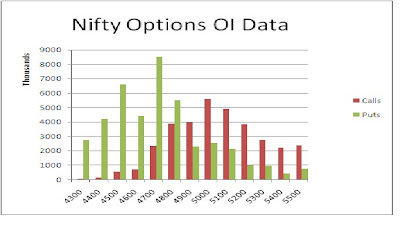

If yesterday it belonged to the Bears, today's Option Charts belong to the Bulls. There was no major action at any of the strikes, except for a major addition of 17 lacs+ OI at 4700 PE by the Bulls. The levels of 4700 now becomes the biggest support level for this series with over 80 lacs+ of OI already. Combining this with our support level of 4690, a short below 4690 would be an obvious trade. However, it seems unlikely as of now. The first major resistance as per the Options Charts is at 5000. 4900 is a minor resistance, while 4800 is a minor support.

If yesterday it belonged to the Bears, today's Option Charts belong to the Bulls. There was no major action at any of the strikes, except for a major addition of 17 lacs+ OI at 4700 PE by the Bulls. The levels of 4700 now becomes the biggest support level for this series with over 80 lacs+ of OI already. Combining this with our support level of 4690, a short below 4690 would be an obvious trade. However, it seems unlikely as of now. The first major resistance as per the Options Charts is at 5000. 4900 is a minor resistance, while 4800 is a minor support.For tomorrow, immediate resistance for Nifty Spot comes at 4860/4865 levels. If sustains above this, it will head for 4905/4910 kind of levels. Above 4910, 4960 and 4990 can come quickly. If it gets closer to 4990/5000, a Short trade will be on with a tight stoploss of 30 points. On the downside, support for Nifty Spot comes at 4815/4820 levels. If moves below this in morning trades, it can again slide upto 4790/4770 levels. A break of 4770 may now bring panic for lower levels of 4720 and 4690.

1 Dec - Nifty Spot resistance at 4865-4885-4910-4960. Support at 4815-4790-4770-4750 - www.niftypower.com

Visit here for Nifty Future Tips and Nifty Options Tips

No comments:

Post a Comment