On Friday, Nifty opened gap up on positive global cues, but could not sustain higher levels and closed just above 5100 level. It got resisted exactly at the Gap resistance of 5150/5170 on Friday, and crossing this zone will be crucial for any further upsides. Once above this, Nifty can easily climb towards 5230/5270 levels. Above 5270, another Gap resistance exists, which Nifty has been unable to close in previous attempts. Hence, positional traders can attempt aggressive longs above 5150/5170 zone in Nifty, with Stop and reverse below Friday's low.

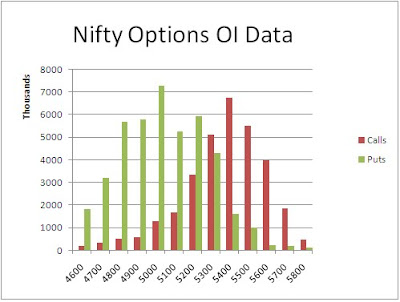

The Nifty Option OI Charts are given below:

There has been a a lot of activity on the Options front in the July series till now. The Bulls were active till 5100 PE strike, where they added nearly 40 lacs OI, the maximum being at 5000 PE and 5100 PE. On the other hand, the Bears were mainly active at higher strikes of 5400 CE and 5500 CE strike, where they added 23 lacs+ OI. Overall, 5000 stands tall as the major support for this series. It would make sense to treat this level as a pivot and be Bullish above this level and Bearish below it. No real resistance has sill formed as per the Option charts. 5100 and 5200 level seems to be the battleground level as of now.

For Monday, immediate resistance for Nifty Spot comes at 5125/5130 level, above which, it will again go and retest its resistance zone of 5150/5170. Above 5170, Nifty will head for higher level resistances of 5230 and 5265. On the downside, support for Nifty Spot comes at 5075/5080 level. Below this, the Bears will have an upper hand and take Nifty down towards lower levels of 5050/5020.

30 July - Nifty Spot resistance at 5130-5160-5205-5230. Support at 5075-5050-5020-4990 - www.niftypower.com

Visit here for Nifty Tips - Nifty Future Tips and Nifty Option Tips