Nifty opened flat today, and traded between its first resistance of 4860 and support for 4820 for the first half, then it broke the support to reach the second support near 4690, and finally recovered a bit to close near the 4800 level. Tomorrow can be a good short term trend deciding day for the Nifty. An upward correction to the big fall from 5400 is on, and it is anybody's guess how far it can go. 4790/4800 levels can be the deciding level for this rally tomorrow. A break below 4770 would confirm a resumption of the downtrend, while a break above 4845/4850 would lead Nifty toward 4900/4960 kind of levels. Treat 4800 as the pivot for tomorrow and take a Hedged Long or Short Trade - Long above it and Short below. The hedging can be removed once Nifty breaks 4770 on the downside or 4850 on the upside.

Nifty opened flat today, and traded between its first resistance of 4860 and support for 4820 for the first half, then it broke the support to reach the second support near 4690, and finally recovered a bit to close near the 4800 level. Tomorrow can be a good short term trend deciding day for the Nifty. An upward correction to the big fall from 5400 is on, and it is anybody's guess how far it can go. 4790/4800 levels can be the deciding level for this rally tomorrow. A break below 4770 would confirm a resumption of the downtrend, while a break above 4845/4850 would lead Nifty toward 4900/4960 kind of levels. Treat 4800 as the pivot for tomorrow and take a Hedged Long or Short Trade - Long above it and Short below. The hedging can be removed once Nifty breaks 4770 on the downside or 4850 on the upside.The Nifty Option Open Interest charts are given below:

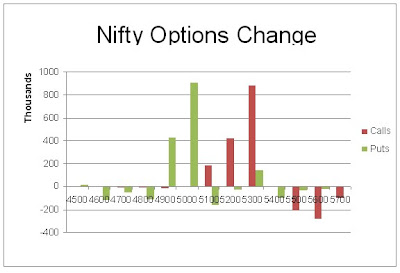

Finally, the Bears decided to act today and made it their day. The added 19 lacs+ OI from 4800 CE to 5000 CE strikes. The Bulls were absent today,a and did little else than covering a small amount of OI at various trikes. 4700 and 4500 are the good support levels for this series, while 5000 is the biggest resistance as of now. 4800 is a minor support, while 4900 is a minor resistance.

Finally, the Bears decided to act today and made it their day. The added 19 lacs+ OI from 4800 CE to 5000 CE strikes. The Bulls were absent today,a and did little else than covering a small amount of OI at various trikes. 4700 and 4500 are the good support levels for this series, while 5000 is the biggest resistance as of now. 4800 is a minor support, while 4900 is a minor resistance.For tomorrow, immediate resistance for Nifty Spot now comes at 4825 and 4845 levels. Above 4845, short covering can quickly take it towards 4900+ kind of levels. On the downside, support for Nifty Spot comes at 4785/4770 levels. Below 4770, intraday panic will be created by the Bears, for levels of 4720 and 4690. As given earlier, treat 4800 as pivot for tomorrow, and stay long above it and short below it.

30 Nov - Nifty Spot resistance at 4825-4845-4875-4905. Support at 4785-4770-4745-4720 - www.niftypower.com

Visit here for Nifty Tips, Nifty Future Tips and Nifty Option Tips