We had a very Volatile session on Budget day, with Nifty swinging 100+ points twice in two hours. Now with the Budget behind us, we can again get back to analyzing the Nifty in our old fashioned way.

Today, although it showed some wild swings, Nifty could not scale its strong resistance zone of 5495-5505 and fell after making a high near 5477. Since it is a high made on big Big News Day, it should be considered the trend reversal point on short term basis for now. On the downside, the last swing low of 5220 was protected on Friday, with Nifty making a higher low around 5232. This can also be considered a panic low for the time being, as Nifty reached there after a big fall on Expiry Day. Hence, this would be the level to watch, for a positional short trade.

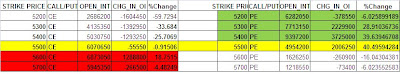

The Options OI table is given below:

The only level where we see decent amount of OI at present is 5300 PE. The other levels would become more active as the days pass by. For now, 5300 looks to be the support level from the Options data. On the upside, 5500 is a weak resistance area, with real resistance lying at 5600 and above. From the Options data 5300 to 5500 is the immediate range for Nifty, with 5400 as the battlezone between the Bulls and the Bears.

The only level where we see decent amount of OI at present is 5300 PE. The other levels would become more active as the days pass by. For now, 5300 looks to be the support level from the Options data. On the upside, 5500 is a weak resistance area, with real resistance lying at 5600 and above. From the Options data 5300 to 5500 is the immediate range for Nifty, with 5400 as the battlezone between the Bulls and the Bears.For tomorrow, immediate resistance for Nifty spot comes at 5345-5355 zone. Sustaining above this, Nifty will again try to head for 5385-5400 and higher levels. On the downside, immediate support for Nifty spot comes at 5305-5310 levels. Break of this would lead it to test lower levels of 5280-5265 and 5235 levels. Since market volatility is good, buying/selling after the breakout/ breakdown would fetch better trades as compared to Buying/ Selling at Supports/ Resistances.

1 March: Nifty spot resistance at 5355-5385-5400-5435. Support at 5305-5280-5265-5235 - www.niftypower.com

Visit here for Nifty Tips